French luxury fashion brand Hermès is suing American digital artist Mason Rothschild who created the MetaBirkins series of NFTs (Non-Fungible Tokens), a rapidly growing part of the cryptoworld.

The lawsuit has once again brought into sharp focus the ongoing debate over NFTs—the uniqueness and the real value of these digital artefacts and the criticisms against them.

Why is Hermès suing Rothschild over MetaBirkins?

Hermès has accused Rothschild of profiteering from the company’s trademark ‘Birkin’, a tote bag introduced by the company in the 1980s.

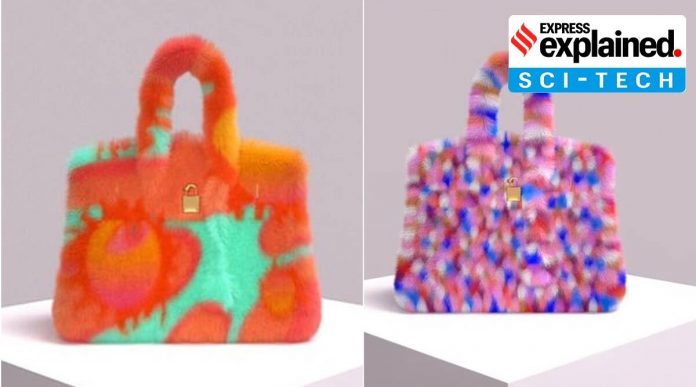

To be clear, Rothschild has not made actual tangible Birkin-type bags. He made digital art inspired by it and titled his artwork the “MetaBirkins”, which is a series of colourful images of tote bags. Subsequently, he sold this artwork as an NFT online.

According to The National Law Review (NLR), Hermès International and Hermès of Paris have filed the lawsuit in the Southern District of New York for trademark infringement and trademark dilution. In its complaint, the brand has detailed the origin and fame associated with the Birkin bag. As per NLR, Hermès owns a US trademark for the word Birkin.

Because of the trademark rights owned by the brand, it has alleged its infringement in their complaint. It has further stated that it is a case of “unfair competition” based on the artist’s sale of the NFT and advertising his artwork as “MetaBirkins”.

NLR reports that the complaint also mentions a cybersquatting claim associated with metabirkins.com. Cybersquatting refers to the unauthorised practice of registering names that are similar or identical to those that are trademarked.

However, Rothschild seems undaunted and has announced on Instagram that he will put up a fight. In a statement posted online, the digital artist said, “I am not creating or selling fake Birkin bags. I’ve made art works that depict imaginary, fur-covered Birkin bags.”

But why are NFTs considered to be unique digital assets?

An NFT is a unique, irreplaceable token that can be used to prove ownership of digital assets such as music, artwork, even tweets and memes. The term ‘non-fungible’ simply means that each token is different as opposed to a fungible currency such as money (a ten-rupee note can be exchanged for another and so on).

Cryptocurrencies such as Bitcoin and Ethereum are also fungible, which means that one Bitcoin can be exchanged for another. But an NFT cannot be exchanged for another NFT because the two are different and therefore unique. Each token has a different value, depending on which asset it represents.

NFT transactions are recorded on blockchains, which is a digital public ledger, with most NFTs being a part of the Ethereum blockchain. NFTs became popular in 2021, when they were beginning to be seen by artists as a convenient way to monetise their work.

What are the other reasons for which NFTs are in high demand?

One of the other attractions is that NFTs are a part of a new kind of financial system called decentralised finance (DeFi), which does away with the involvement of institutions such as banks. For this reason, decentralised finance is seen as a more democratic financial system because it makes access to capital easier for lay people by essentially eliminating the role of banks and other associated institutions.

Even so, because NFTs operate in a decentralised system, any person can sell a digital asset as one. This can sometimes create problems. For instance, if you were to sell someone else’s artwork as an NFT, you could essentially be infringing on copyright. This is what happened in the case of the MetaBirkins as well.

What happened at some recent NFT auctions?

In October last year, The Economist created an NFT of one of its issue’s cover images that depicts Alice from “Alice in Wonderland” looking into the rabbit hole that gives her a glimpse “into this weird new world” where words such as cryptocurrencies, Ethereum blockchains and metaverse are coming into the mainstream.

In March 2021, Twitter’s ex-CEO Jack Dorsey sold the platform’s first Tweet as an NFT. The tweet, which Dorsey had put out in March 2006, stated “just setting up my twttr”. This tweet that would probably offend grammar pedants fetched over $2.9 million. This amount would have been credited to Dorsey’s crypto wallet.

What is the criticism against NFTs?

One of the criticisms of NFTs is that it creates value where none exists such as in the case of selling memes and tweets for hefty sums. Another more common criticism of NFTs is the greenhouse gas emissions associated with making these transactions, considering the high amounts of electricity they consume.

According to the Cambridge Bitcoin Electricity Consumption Index, the amount of electricity consumed by the Bitcoin network in a single year could satisfy the total electricity needs of the University of Cambridge for 993 years or could power all tea kettles used to boil water in the UK for 30 years.

The website ‘Valuables by Cent’, through which Dorsey auctioned his tweet as an NFT, allows any person to place an offer on any tweet. Buying a tweet means that the individual gets a digital certificate—which is signed and verified by the tweet’s creator—proving their ownership of the tweet.

Once an individual has purchased a tweet, they can resell the tweet on the website or display them in their online gallery. Buyers can also choose to keep the tweet in their private collection.

But why would someone buy a tweet in the first place? The website lists this question in its FAQs and offers the following answer, “Every day, valuable moments happen within the span of a tweet. Turning these moments into NFTs captures that value in the form of digital collectibles. Purchasing an NFT from someone creates the beginning of a direct relationship between you and them. That’s pretty cool.”

Newsletter | Click to get the day’s best explainers in your inbox

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Mantle

Mantle  Cronos

Cronos  Render

Render  Pepe

Pepe  Stellar

Stellar  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  dogwifhat

dogwifhat  OKB

OKB  Bittensor

Bittensor  Renzo Restaked ETH

Renzo Restaked ETH  Immutable

Immutable  XT.com

XT.com  Arbitrum

Arbitrum  Maker

Maker  Optimism

Optimism  The Graph

The Graph  Wrapped eETH

Wrapped eETH