Join Our Telegram channel to stay up to date on breaking news coverage

Decentralized finance (DeFi) contributed $9.59 billion to this volume. This constitutes approximately 13.32% of the total crypto market activity during this period. Meanwhile, stablecoins played a substantial role, representing $63.35 billion in volume, accounting for 88.01% of the 24-hour crypto market activity.

Bitcoin saw a marginal decrease in dominance, currently at 52.42%. This marks a slight decline of 0.08% over the day.

5 Best Altcoins to Invest in Right Now

The global cryptocurrency market experienced a slight decrease of 3.53% in its overall market cap, currently at $1.57 trillion. However, within the last 24 hours, there was a notable surge in trading activity, with the total market volume reaching $71.97 billion, marking a significant increase of 34.98%.

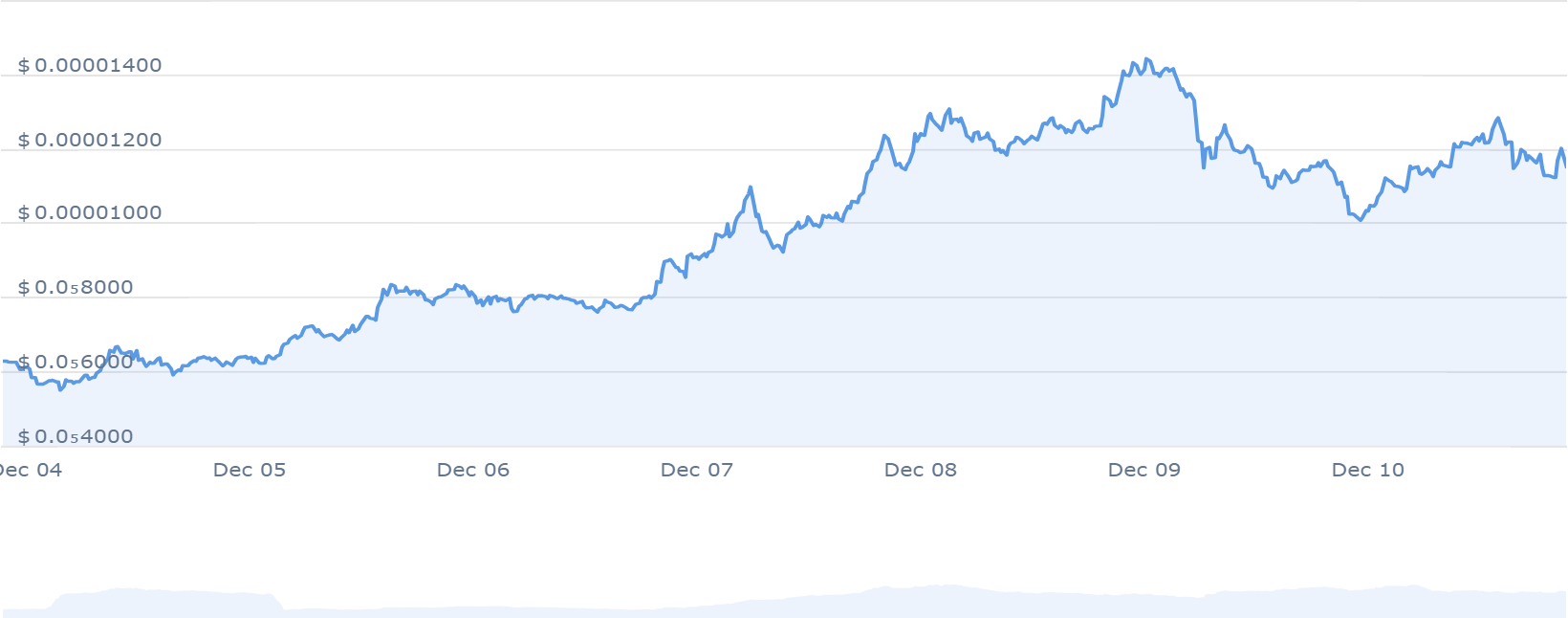

1. eCash (XEC)

The performance analysis of eCash (XEC) reveals several vital indicators. Over the past year, its price has surged by 23%, exhibiting a positive trend. Trading activity indicates that the currency is currently positioned above the 200-day simple moving average, reflecting sustained momentum.

Within the last 30 days, eCash has seen 15 days of positive growth, accounting for 50% of the observed period. The coin boasts high liquidity, evidenced by its substantial market capitalization. Moreover, the yearly inflation rate for eCash stands at 1.77%.

Moreover, predictions suggest a bullish sentiment regarding eCash’s future price movements. Currently, the Fear & Greed Index stands at 74, indicating a phase of “Greed” in the market sentiment.

🚀 PayButton-Server v1.0.2 is here!

✅ New ‘advanced’ options for the Button Generator 🔳

✅ Improved handling of addresses with large numbers of transactions ⚡

✅ Improved Build Process ⚙️

✅ UI/UX Improvements 🎨

✅ Bug Fixes 🐞Read more ⤵️https://t.co/j1mRspyolN https://t.co/E4U8jqivKW

— eCash (@eCashOfficial) December 8, 2023

Regarding supply metrics, the circulating supply of eCash is 19.58 trillion XEC out of a maximum supply of 21.00 trillion XEC. The annual supply inflation rate is 1.77%, creating 340.68 billion XEC in the past year.

Meanwhile, in the Layer 1 sector, eCash ranks #41 based on market cap. Various experts anticipate significant growth potential for eCash within the crypto market. Predictions suggest a potential maximum price of $0.0000696 as the market recovers.

2. Bonk (BONK)

Bonk has recently experienced a resurgence in its value, capturing the market’s attention. The token’s value spike points to several key factors. Notably, its listing on major cryptocurrency exchanges, such as Binance and KuCoin, significantly drove its price upward.

Unlike traditional patterns where listing announcements precede price surges, KuCoin’s listing offered additional promotional incentives, including rewards of up to $58,000. Moreover, Binance’s introduction of BONK derivatives contracts widened the coin’s exposure to crypto traders.

Another contributing factor to BONK’s momentum is the optimism surrounding the Solana ecosystem. The overall growth within Solana’s decentralized finance (DeFi) sector has positively influenced Solana-based tokens. This allows BONK to outperform some Ethereum-based tokens due to Solana’s strong performance this year.

The sentiment regarding BONK’s price prediction is currently neutral. At the same time, the Fear & Greed Index stands at 74, indicating a state of greed in the market sentiment. As for its market metrics, BONK’s current circulating supply amounts to 46.50 trillion out of a maximum supply of 100.00 trillion. The token also holds the #4 rank among Meme Coins by market capitalization.

#BitcoinMinetrix revolutionizes cloud mining!

No money changes hands with ERC-20 #Tokens! 💸

Own your #Bitcoin mining power with earned mining credits via #BTCMTX token staking. ⛏️

Thanks to Ethereum’s smart contracts, user allocations are safely auto-managed. 🔐 pic.twitter.com/yRaYyZpSkl

— Bitcoinminetrix (@bitcoinminetrix) December 10, 2023

BONK is trading above its 200-day simple moving average, highlighting its market performance and indicating a positive trend. Over the last 30 days, it grossed 17 green days. This accounts for 57% of the period, reflecting a recent positive trend. Additionally, BONK demonstrates high liquidity based on its market capitalization.

3. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix is a cloud mining platform that introduces tokenization to address concerns related to third-party cloud mining scams. It aims to offer a secure and transparent method for individuals to engage in Bitcoin (BTC) mining in a decentralized manner.

As per available data, the project reports over 400,000 BTCMTX tokens currently locked in staking. Furthermore, the current annual percentage yield (APY) stands at 103,225%, but it’s expected to decrease with increased token staking.

Regarding token allocation, Bitcoin Minetrix directs 42.5% of the BTCMTX tokens to fund mining operations. In comparison, 35% is channeled towards marketing efforts and the growth of BTCMTX. An additional 15% is reserved for community rewards to acknowledge active participation. 7.5% is also designated for BTCMTX staking rewards until the Bitcoin Minetrix cloud mining platform is completed.

#BitcoinMinetrix revolutionizes cloud mining!

No money changes hands with ERC-20 #Tokens! 💸

Own your #Bitcoin mining power with earned mining credits via #BTCMTX token staking. ⛏️

Thanks to Ethereum’s smart contracts, user allocations are safely auto-managed. 🔐 pic.twitter.com/yRaYyZpSkl

— Bitcoinminetrix (@bitcoinminetrix) December 10, 2023

During the ongoing BTCMTX presale, the project has raised over $5,153,637 by offering BTCMTX tokens at 0.0121 per token. Of the total token supply of 4 billion, 70% (2.8 billion BTCMTX) is available during this presale phase. Interested participants can access these tokens through Ethereum (ETH) or Tether (USDT) investments, with a minimum investment requirement of $10.

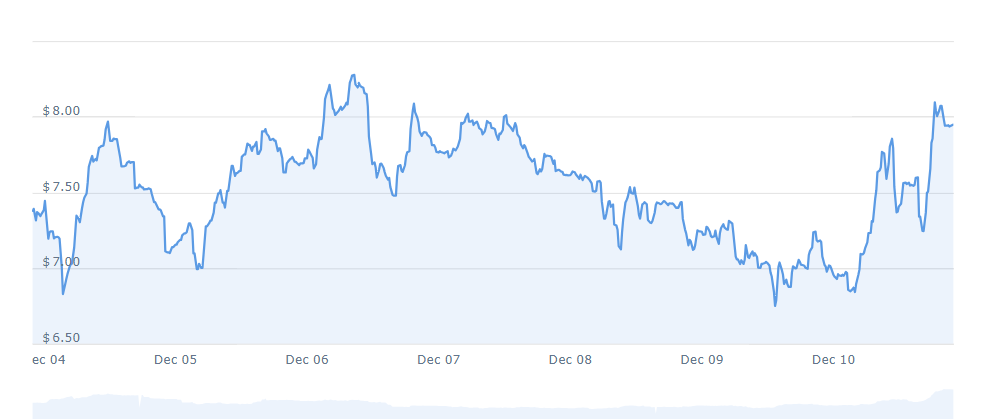

4. Echelon Prime (PRIME)

Echelon Prime, trading at $7.95 presently, exhibits several notable trends. It stands above its 200-day simple moving average. It has experienced 16 positive days within the last 30, accounting for 53% of its recent performance. This places it near its cycle high, suggesting a relatively strong position.

Examining historical price points, Echelon Prime hit its peak price on Nov 28, 2023, at $8.97, marking its all-time high. However, data regarding its all-time low is unavailable, making it difficult to establish the full scope of its price history. Since reaching its all-time high, the lowest recorded price is $6.73, indicating a cycle low. Meanwhile, the highest price observed after this cycle low was $8.12, signifying a cycle high.

Three days left! Sanctuary goes live on Monday.

Check out this article for details on our upcoming @ParallelTCG marketplace.https://t.co/uowhm8Hrwb pic.twitter.com/aJIhKu7MD9

— Echelon (@EchelonFND) December 8, 2023

Echelon Prime’s circulating supply currently consists of 26.27 million PRIME tokens out of a maximum supply of 111.11 million. As for market sentiment, the current outlook is bullish, coinciding with a Fear & Greed Index showing 74 (Greed).

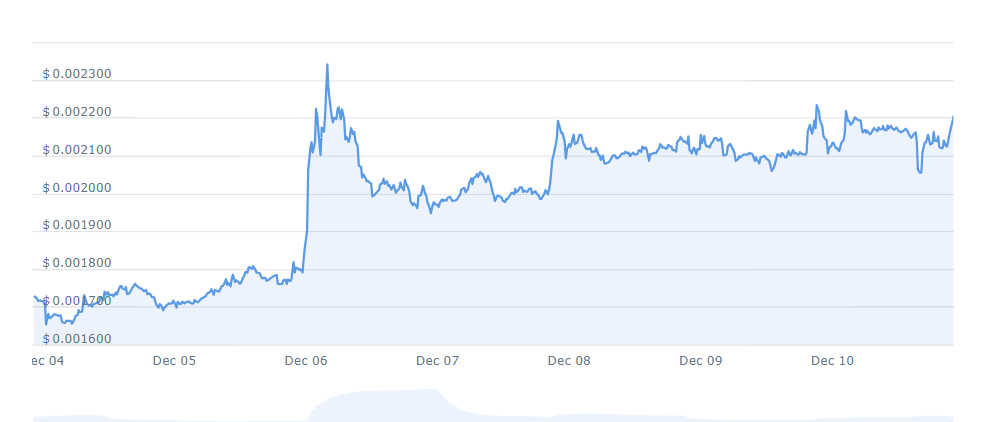

5. Holo (HOT)

Holo, an Ethereum (ERC20) token, has experienced significant fluctuations in its price over the last year. The price has surged 29% during this period, currently at $ 0.002215, marking a 2.88% increase in the previous 24 hours. This increase contrasts the token’s highest price of $ 0.031382 on April 5, 2021, and its lowest price of $ 0.000202 on March 13, 2020.

The token has demonstrated positive market trends, trading above its 200-day simple moving average, indicating sustained upward momentum. Additionally, its recent performance displays promise, with 17 out of the last 30 days registering gains, equivalent to a 57% positive trading record.

Holo also exhibits considerable liquidity, which is evident from its market cap of $ 382.06M and a 24-hour trading volume of $ 26.18M. Therefore, it contributes to HOT’s current rank of #40 in the Ethereum (ERC20) Tokens sector and #51 in the Layer 1 sector.

📣 Hot off the press! Holo is glad to share that the Network-RC is on its way this December! This marks a significant milestone in our journey towards decentralized application hosting. ➡️ Read the Lead/Org https://t.co/RY5rMgud8I.

— Holo (@H_O_L_O_) December 7, 2023

Based on sentiment indicators, the Holo price prediction leans bullish, indicating positive market sentiment. At the same time, the Fear & Greed Index records 74 (Greed) during this analysis. These metrics reflect investor sentiment and expectations regarding the token’s future performance.

Read More

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 100% APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Aptos

Aptos  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  OKB

OKB  Immutable

Immutable  Render

Render  Renzo Restaked ETH

Renzo Restaked ETH  XT.com

XT.com  Pepe

Pepe  Arbitrum

Arbitrum  Bittensor

Bittensor  dogwifhat

dogwifhat  Maker

Maker  Wrapped eETH

Wrapped eETH  The Graph

The Graph  Optimism

Optimism