Following a violent correction and with no small amount of schadenfreude, various corners of the legacy press have pronounced that cryptocurrency assets, including NFTs, are as dead as disco. The May 10th collapse of “stablecoin” TerraUSD (UST); an ill-conceived instrument that used the algorithmically governed, automatic minting of associated LUNA coins to maintain its peg to the US dollar, was the first domino. (The Deep Dive’s Hermina Paul has the details.)

Anything that can be forced to mint more of itself to maintain a peg is vulnerable to a Soros-style attack, so one might consider UST / Luna to have been walking dead for quite some time before they were finally buried last week. Cryptocurrencies’ many detractors are telling anyone who will listen that TerraUSD can’t be the only wooden nickel in the bunch.

There isn’t any intrinsic value in any cryptocurrency or token, and there never has been. Ever since bitcoin became a household name, a plague of tokens have been built around convoluted gimmicks in a desperate search for relevance. Many of them, on paper, are attempts to convert on the promise that blockchain technology could provide anything at all in terms of utility. The ever-growing crypto universe has become a tangle of tokens for everything from store loyalty points to components of credit scoring mechanisms.

A galaxy of NFTs within that universe has become the latest vehicle for celebrities to monetize their notoriety in a mimicking of the market for fine art (more on the NFT scarcity slight-of-hand here). The latest of these is a three-video collection of Madonna NFTs called Mother of Creation, which feature a full-frontal animation of The Material Girl giving vaginal birth to various creatures meant to represent art, creativity, nature and technology, including some robotic centipedes.

The Deep Dive has been unable to confirm the accuracy of the rendering, because neither Warren Beatty, Jose Canseco, Alex Rodriguez, Sean Penn, Lenny Kravitz, Dennis Rodman, Guy Richie, nor Vanilla Ice returned our calls, and JFK Jr. and 2pac are dead.

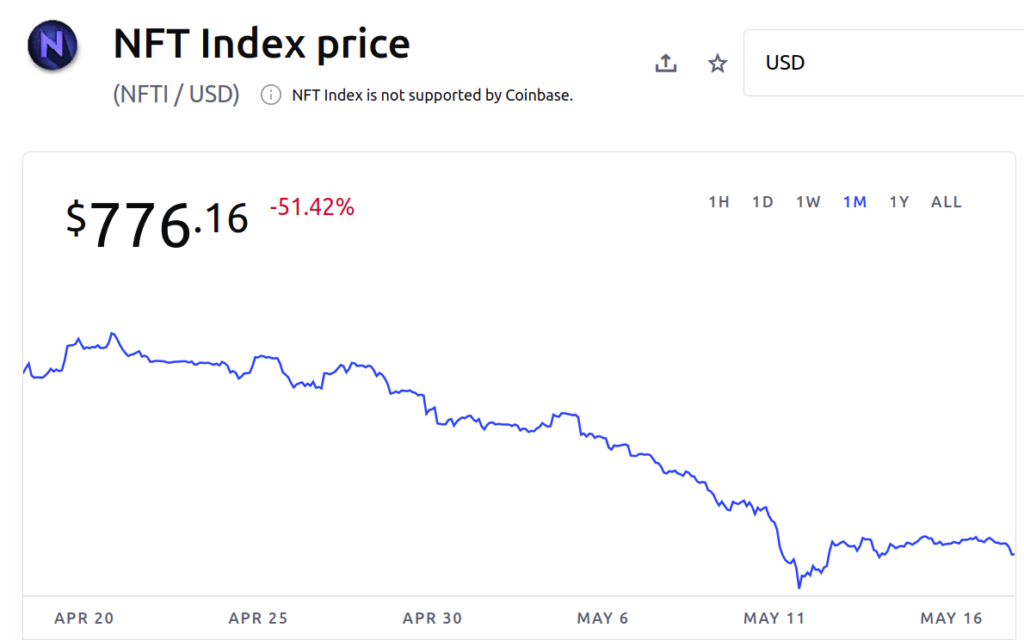

The market for NFTs (as measured by the index) took a pronounced dive upon Mother of Creation‘s launch, which was probably just bad timing, but when a joke that David Letterman wore out twenty years ago becomes a high-profile feature of anything, people are sure to wonder if it’s out of new ideas.

Whether NFTs sold off because they’re finally played out, or it’s just part of the broader collapse hardly matters. It’s over. Done. Finished. Fat lady singing. Curtains.

Volume and price are way down across the board, as all of these coins and tokens and everything they’re trying to be climbs on the express elevator down to its true value. The lesser-known coins are looking like change someone dropped on the floor, and the most followed coin, the one whose runaways and breakouts started this renegade financial fad, has been beat down to… around $30,000 per unit?

The idea that a digital construct whose owners get no yield or voting power of any kind could be worth a year’s rent is as absurd as the idea that it could be worth as much as a new Mercedes, but here we are. Can anyone think of a good reason it could never be worth as much as a new house?

The imitator coins, the meme coins, and the Ethereum-chain tokens all trying to be the next thing all move in Bitcoin’s updraft, and figure to stay that way for as long as cryptocurrencies remain the only thing they’ve ever been: a means of speculation.

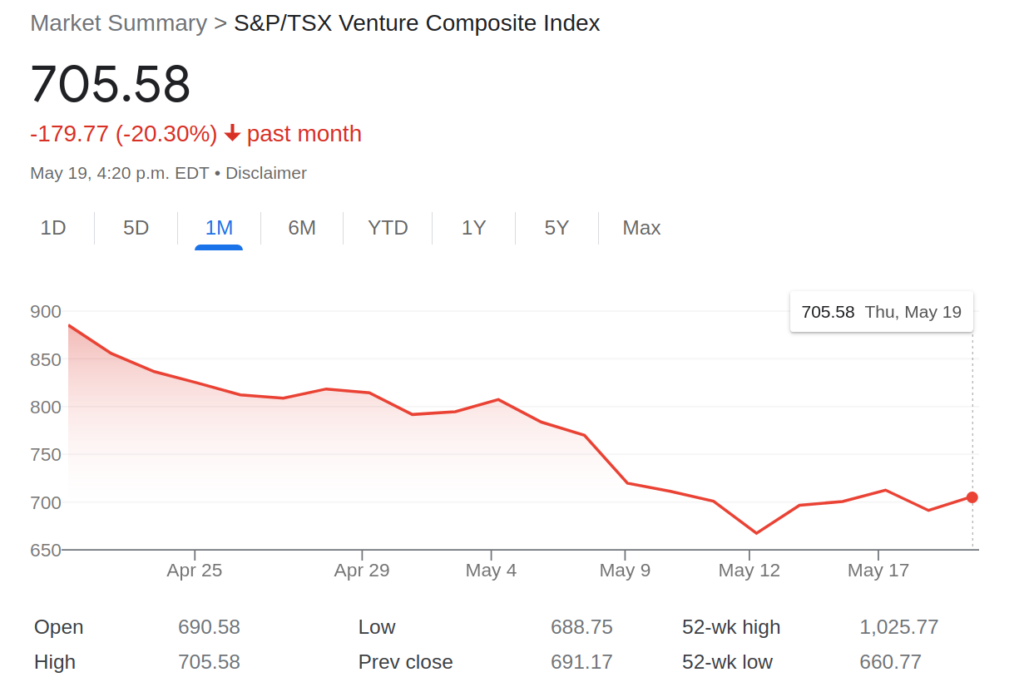

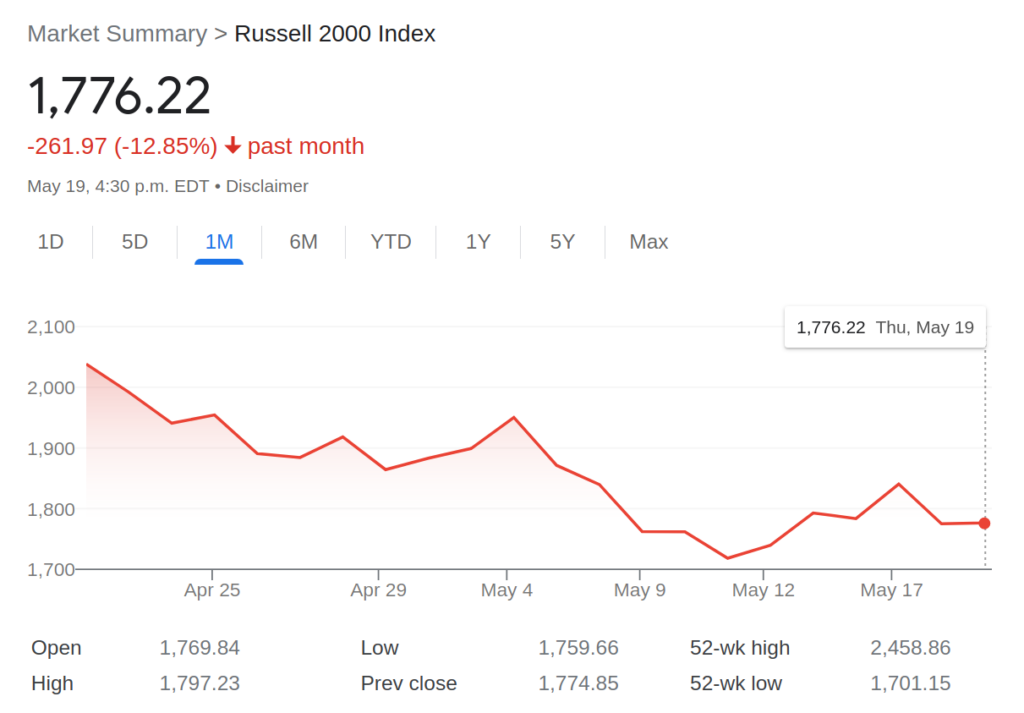

As the financial landscape shifts and the available yields change, so does the asset mix of managed money looking for a return. The risk-on trades are the first ones kicked to the curb. We’re seeing the same kind of “aggressive de-risking” in smallcap and microcap stocks which, if you think about it, are basically crypto tokens that were minted by the companies whose equities they represent, that come with the additional benefit (and burden) of laws made to govern them, and commissions tasked with regulating them.

The latest champion of the blockchain’s practical utility is investment manager Mark Wiseman, Chair of the Alberta Investment Management Corporation (AIMCO), and advisor to various investment management and private equity outfits. Wiseman’s version of the crypto-is-the-future song is the most appropriate one yet: he has the blockchain’s (theoretical) ability to tokenize legal title to pretty much anything, enabling the securitization of pretty much everything and, implicitly, the use of anything with any value as an instrument of speculation.

Wiseman’s May 17th editorial in the Globe and Mail casts the development of an ability to put everything from real estate to Madonna’s vag on the blockchain and trade it as a way to stimulate the Canadian economy while also effecting a wealth re-distribution. Imagine if all assets could be publicly traded! They could all become accessible to all investors! Big and small! (But especially big…)

Wiseman’s very realistic (if not at all reasonable) futurism is part of a sustained push at The Globe to temper expectations being set by Conservative MP Pierre Poilievre’s adoption of cryptocurrencies as artillery in his war against the Bank of Canada, and from a wide angle it’s pretty funny.

Poilievre’s anti-inflation bluster is built around the simplistic rhetoric that an abundance of currency driving prices up is the result of central banks that are way out of control. These power-abusing elites need a check on their authority!.. the story goes. A self-regulating, non-fiat money like bitcoin is the way forward!

It’s a weaponization of the kind of dumb, satisfying idea that made Joe Rogan number one: easy, appealing, uncomplicated answers billed as solutions to complicated, serious problems. The crypto market getting staggered probably isn’t going to be enough to kill it, and Wiseman and the Globe‘s masthead are convinced that it’s nonsense.

Poilievre isn’t going to reign in the Bank of Canada in any meaningful way, certainly not through the application of blockchain or the creation of a cryptocurrency. He can’t even explain what “a right to choose our money,” means or what difference it would make. But for all practical purposes, he doesn’t have to. He isn’t trying to sell the idea or even reach anyone who might understand it. He’s creating an outlet for income earners to take an important, necessary, tactical position against the elites, who they know in their souls created this mess!

There’s no use in fighting a self styled straight talker like Poilievre, who deals in “hard truths” that he adapted from some libertarian message board last week. That’s just more proof that “they” don’t want him to succeed, because “they” don’t want YOU to succeed! Instead, Wiseman, a professional asset manager, would like for us to consider that Polivere is on the right track in the wrong direction. Don’t think of cryptocurrencies as a way to shackle our great, independent national bank; think of them as a way to liberate the value of everything you own, and give hard working entrepreneurs like himself and the institutions he manages the ability to trade it. To lend you money against it. To give all Canadians the same type of even, predictable, practical and natural wealth re-distribution engine that works so efficiently in capital markets and casinos.

Information for this briefing was found via Edgar, Coinbase, The Globe and Mail, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Braden Maccke is a writer from British Columbia, the lone member of The Deep Dive‘s West Coast Contingent.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Renzo Restaked ETH

Renzo Restaked ETH  Render

Render  OKB

OKB  Pepe

Pepe  Immutable

Immutable  XT.com

XT.com  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  dogwifhat

dogwifhat  Optimism

Optimism  Wrapped eETH

Wrapped eETH  The Graph

The Graph