While market attention is focused on the debate over the U.S. debt ceiling, potential implications for crypto markets have garnered less discussion.

The Treasury General Account (TGA), the primary operational account of the U.S. Treasury, has been playing a crucial role in offsetting Federal Reserve’s quantitative tightening policy.

Historically, the TGA’s primary purpose has been to aid the federal government in managing its payments efficiently. However, in the context of the looming debt ceiling crisis, the account has been gradually drained to ensure the continuous servicing of government bills.

The TGA balance has dwindled from approximately $1.8 trillion in June 2020 to $61.9 billion in May 2023 — a 96% decrease. Since the beginning of the year, the TGA balance dropped by over 85%.

The Federal Reserve’s quantitative tightening policies have aimed at reducing the amount of money in circulation, exerting upward pressure on interest rates to curb borrowing activity. However, the TGA’s draining has offset these tightening measures, effectively injecting liquidity into the market and somewhat counteracting the tightening effects.

Once the debt ceiling is raised, the Treasury has signaled its intention to bolster the TGA balance to its target of $500 billion. To accomplish this, it would have to raise approximately $440 billion. The primary method for gathering these funds would be issuing Treasury Bills (T-bills), which would inevitably siphon additional liquidity from the market.

According to data presented by the Treasury Department, the average value of T-bills issued per month over the past three years has hovered around $220 billion. This suggests that to raise the necessary $440 billion, the Treasury would need to ramp up T-bill issuance over two months, given the usual issuance volumes.

However, this estimate could be subject to fluctuation as the exact timeline would depend on various factors, including market demand and economic conditions. Goldman Sachs believes the Treasury could issue up to $700 billion in T-bills within six to eight weeks of a debt deal. Overall, Goldman expects the Treasury to supply the market with over $1 trillion worth of T-bills on a net basis this year.

This increased T-bill issuance could double the quantitative tightening effect, posing a significant threat to the financial and crypto markets. As the money supply shrinks, a liquidity crunch could ensue, potentially leading to falling asset prices across the board. Analysts at Bank of America said this could have an equivalent impact on the economy as a 25 basis points rate hike.

The implications of this move extend well into the future. T-bills, typically maturing in one year or less, would not only absorb a substantial amount of liquidity upon issuance but also tie up those funds for the duration of the bill’s term. This means the impact on market liquidity could be felt up to a year following the increased issuance, assuming the Treasury primarily uses one-year T-bills to refill the TGA.

The crypto market could experience a pronounced downturn as investors’ risk tolerance diminishes in response to tighter monetary conditions.

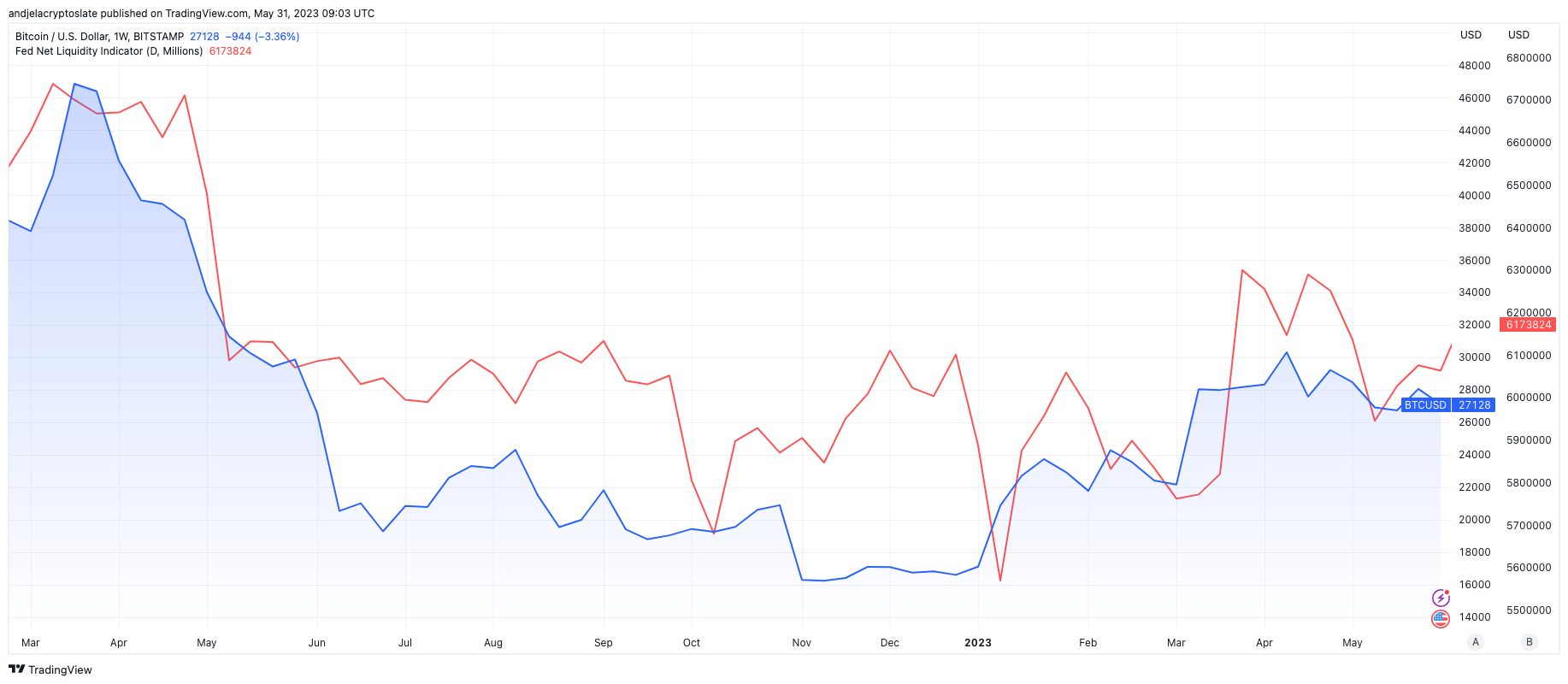

Since 2022, Bitcoin has shown an increased correlation to net liquidity. A CryptoSlate report from April 22 this year found that an increase in the overall amount of money available in the market correlated to a rise in Bitcoin’s price.

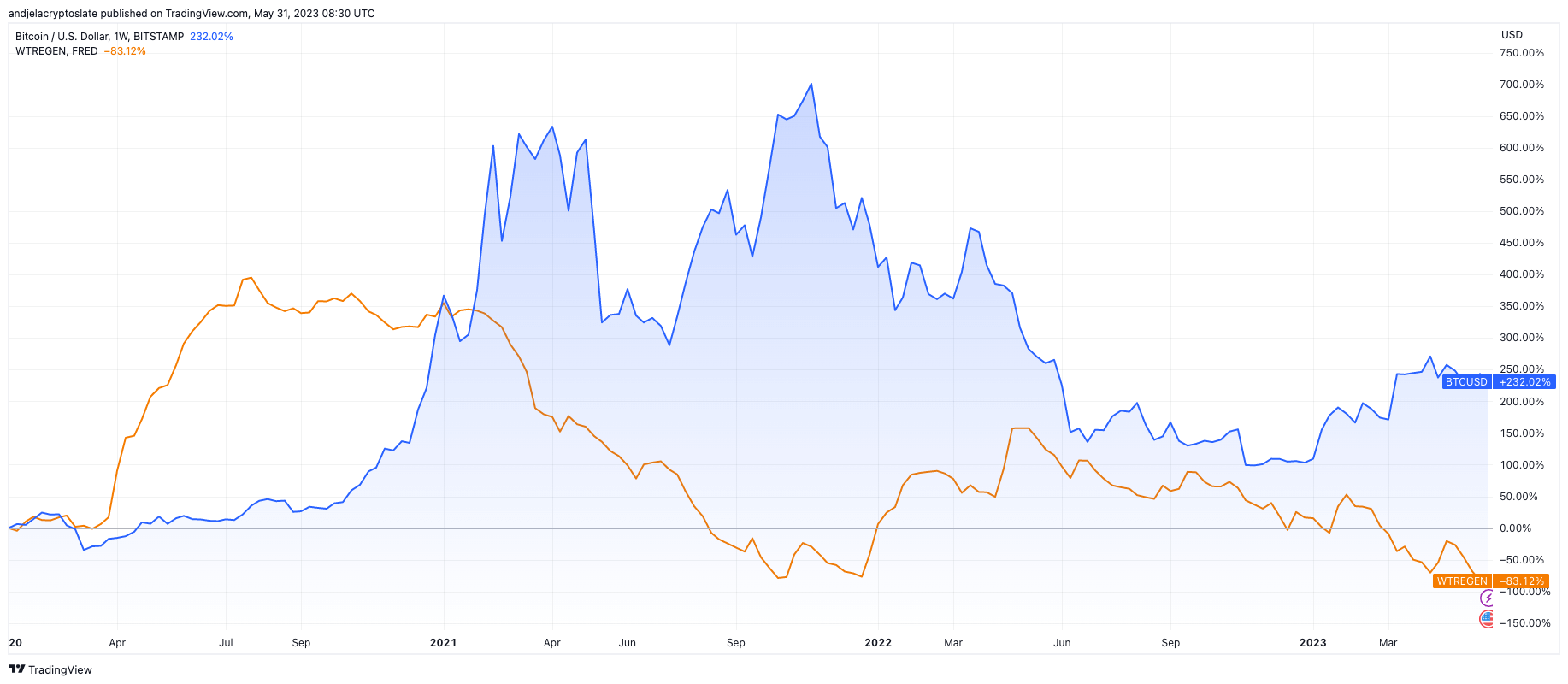

Conversely, Bitcoin has also exhibited an inverse correlation to the TGA balance. Since 2020, every increase in the Treasury General Account correlated with a drop in Bitcoin’s price.

In conclusion, while the market is absorbed in the drama of the U.S. debt ceiling debate, the real story lies in the looming liquidity crisis. The Treasury’s potential T-bill issuance to replenish the TGA balance could drastically tighten the market’s liquidity, prompting asset price depreciation in both financial and crypto markets. While it’s likely that Bitcoin would see a rebound and defy the overall market trend, the short-term effects on the market could be severe.

The post Crypto markets brace for impact as US debt ceiling debate threatens liquidity crunch appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Toncoin

Toncoin  Dogecoin

Dogecoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Fetch.ai

Fetch.ai  Internet Computer

Internet Computer  Uniswap

Uniswap  Dai

Dai  LEO Token

LEO Token  Render

Render  Ethereum Classic

Ethereum Classic  Hedera

Hedera  First Digital USD

First Digital USD  Aptos

Aptos  Pepe

Pepe  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Mantle

Mantle  Filecoin

Filecoin  Wrapped eETH

Wrapped eETH  Immutable

Immutable  dogwifhat

dogwifhat  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  Optimism

Optimism  Arbitrum

Arbitrum  Arweave

Arweave  Bittensor

Bittensor