Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Fantom, rising 32.44%.

- The European Union (EU) should step up the monitoring of digital currencies to prevent a situation where crypto crises like the collapse of the FTX exchange can pose a systemic risk, an EU lawmaker said. The bloc has reached a preliminary agreement on its first major crypto regulation proposal, known as Markets in Crypto assets, which would address supervision of service providers, as well as consumer protection and environmental safeguards for crypto assets such as Bitcoin and Ether, writes Bloomberg.

- Bitcoin spiked higher on Wednesday in the countdown to a speech by Federal Reserve Chair Jerome Powell that may cement expectations for a slower pace of interest rate hikes in the U.S. The token added 3.7%; the highest level in two weeks, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was BinaryX, down 19.88%.

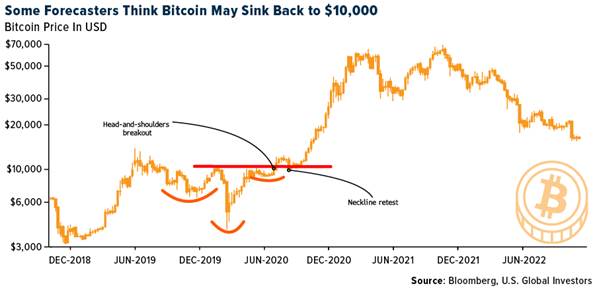

- The crypto route has room to run, according to veteran fund manager Mark Mobius who sees Bitcoin going down to $10,000. The co-founder of Mobius Capital Partners said in an interview Monday in Singapore that his next target for Bitcoin is $10,000 and he wouldn’t invest his own cash or client money in digital assets as it’s too dangerous, writes Bloomberg.

- The U.S. Securities and Exchange Commission is one of the largest creditors to BlockFi, which filed bankruptcy in the wake of a number of failures within the digital-assets space. The regulator has a $30 million unsecured claim against the crypto lender, which makes it BlockFi’s fourth-biggest creditor, writes Bloomberg.

Opportunities

- Binance bought a Japanese crypto exchange service provider to re-enter a market it said will play a “key role” in the future of cryptocurrency adoption. The firm acquired 100% of Sakura Exchange Bitcoin, paving the way for it to enter Japan as a regulated entity. The purchase will give Binance its first license in East Asia, writes Bloomberg.

- The Japanese subsidiary of Sam Bankman-Fried’s failed crypto empire FTX has put together a draft for clients to withdraw funds, in what would be one of the rare cases of investors getting money back from the collapsed exchange. FTX Japan customer balances would be transferred to a platform called Liquid after a verification process so that users can withdraw their money, according to Bloomberg.

- Creators selling NFTs on OpenSea collectively earned $1.1 billion this year, with 80% of that amount allocated to collections outside the top 10. These earnings do not include sponsorship revenue, engagement incentives or grants, writes Bloomberg.

Threats

- BlockFi Inc. filed for bankruptcy, the latest crypto firm to collapse in the wake of crypto exchange FTX’s rapid downfall. Blockfi said in a statement Monday that it will use the Chapter 11 process to “focus on recovering all obligations owed to BlockFi by its counterparties, including FTX and associated corporate entities,” writes Bloomberg.

- Bankrupt cryptocurrency lender BlockFi has sued two companies with ties to Sam Bankman-Fried’s Alameda Research to recover Robinhood stock used as collateral for loans. BlockFi claims it has secured interest in the collateral, but Alameda has declined to turn over the stock. Their tussle reflects the tangled cryptocurrency connections that have caused several large crypto firms to file for bankruptcy, writes Bloomberg.

- Crypto exchange Kraken is laying off 30% of its workforce, or about 1,100 people, the company said in a blog. The news follows similar moves by many rival exchanges, including Coinbase Global Inc. and Gemini. Many exchanges have seen trading activity fall off in recent months, as falling crypto prices led many traders to stay on the sidelines. The recent collapse of crypto exchange FTX added to market uncertainty, writes Bloomberg.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

|

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  Immutable

Immutable  Render

Render  XT.com

XT.com  Pepe

Pepe  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  Optimism

Optimism  dogwifhat

dogwifhat  Wrapped eETH

Wrapped eETH  The Graph

The Graph