Quick Take

The bond market is exhibiting significant destruction, as reflected by the current state of the U.S. 10Y note. Recently, the yield on the note surged above 4.843%, a high unseen since 2007 and just 17bps from the 5% mark. This high-yield period precedes the creation of Bitcoin by several years, illustrating just how long ago it was.

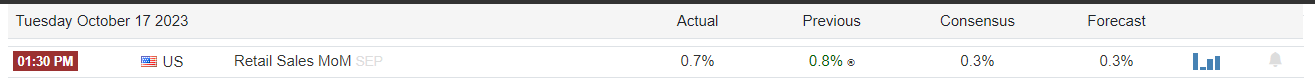

The rise in U.S. yields follows a considerable unexpected surge in U.S. retail sales, where the month-over-month increase reached 0.7%, more than double the initial projection of 0.3%.

This surge signifies a strong sell-off in the bond market, evident in the performance of long-duration bonds such as the TLT, a 20-year+ treasury bond. The TLT opened at a notably low level of 84.89, a mark only replicated a scant few times in 2004 and 2006.

This paints a stark picture of the upheaval bonds have endured due to the most rapid tightening of interest rates witnessed in four decades. The bond market is in a precarious position due to the intricate inverse relationship between bonds and yields, a dynamic that becomes even more critical in the current climate of swiftly rising interest rates.

The post Echoes of ’07: 10-year U.S. Treasury note yield rises to pre-crisis levels appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Filecoin

Filecoin  Stellar

Stellar  Renzo Restaked ETH

Renzo Restaked ETH  Cosmos Hub

Cosmos Hub  Render

Render  Pepe

Pepe  OKB

OKB  Immutable

Immutable  XT.com

XT.com  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  Optimism

Optimism  Wrapped eETH

Wrapped eETH  dogwifhat

dogwifhat  The Graph

The Graph