Quick Take

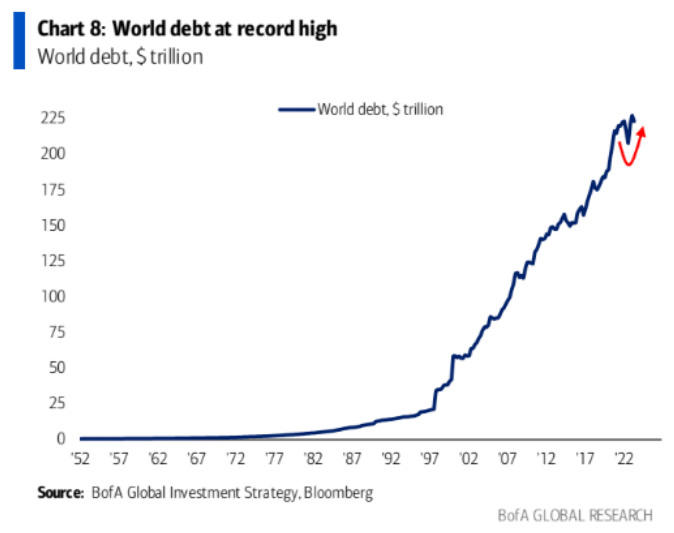

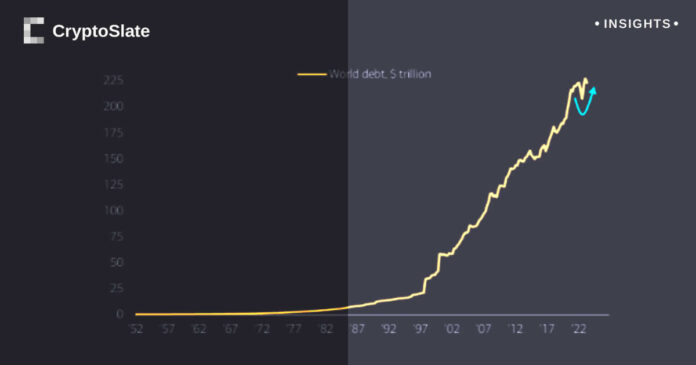

Dylan LeClair, an analyst at Bitcoin Magazine, sheds light on the current U.S. debt to GDP scenario. He reveals that the ratio is approximately 119%, a decrease from a brief peak of 134%. This situation results from inflation compounding at a rate of 5.7%. LeClair further suggests a potential solution to reduce the debt to GDP ratio: adopting negative real yields, wherein bond yields fall below inflation.

Understanding Strategies to Reduce Debt to GDP

Jeroen Blokland, of research firm True Insights, proposes several strategies to mitigate the rising debt to GDP ratio. These methods include:

- Austerity: This approach implies government frugality, i.e., spending less. However, Blokland notes that austerity often leads to reduced GDP growth.

- Increased GDP Growth: This can be achieved through improved productivity and a bolstered labor force, even though this might be adversely affected by rising interest rates.

- Lower Interest Rates: This strategy allows for less coupon and more repayment, consequently reducing the debt.

- Inflation: By inflating the debt away, it becomes cheaper to repay.

- Debt Cancellation or Jubilee: While this is a more radical approach, it serves as a possible last resort solution.

With the current interest rates sitting at 5% in the U.S. and increasing across the western world, the debt continues to become more expensive to repay. This challenge would be further exacerbated by a diminishing labor force.

The post Global debt now over two times greater than the global economy appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Renzo Restaked ETH

Renzo Restaked ETH  Pepe

Pepe  OKB

OKB  Render

Render  Immutable

Immutable  XT.com

XT.com  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  Optimism

Optimism  dogwifhat

dogwifhat  Wrapped eETH

Wrapped eETH  The Graph

The Graph