Claims about crypto exchange Huobi’s financial health and its executives’ legal entanglements have fueled market speculation over the weekend.

Huobi has been witnessing continued outflows from its total locked-up value (TVL), dropping to $2.4 billion from a level of $3 billion in July. As reported by FX168 Financial News, there have now been rumors that several Huobi exchange executives had been taken into custody by the Chinese police.

However, these claims were categorically denied by Justin Sun, a global advisor to the company, who took to social media to debunk the rumors. Despite these assurances, the market sentiment remained skeptical as the outflow continued.

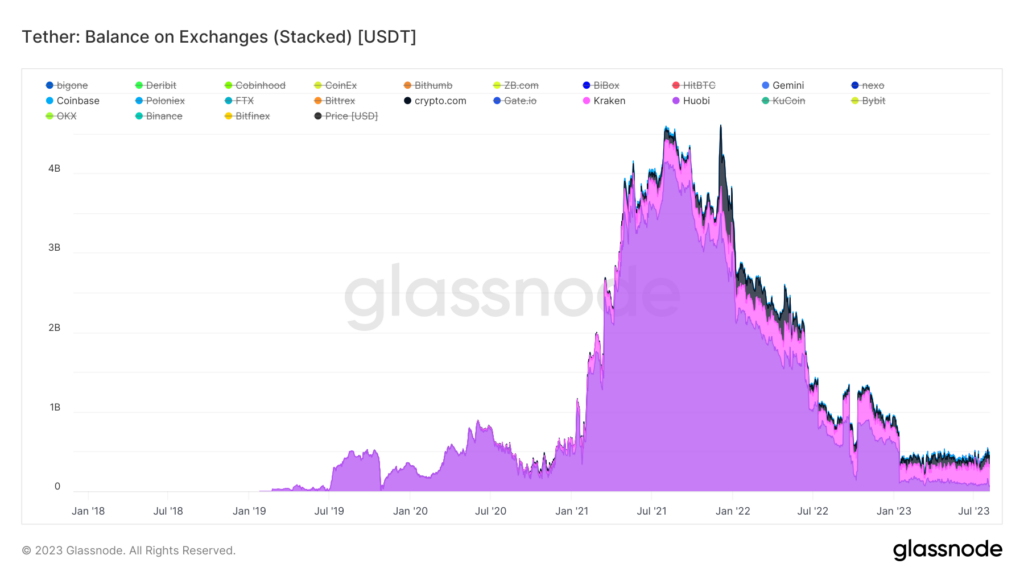

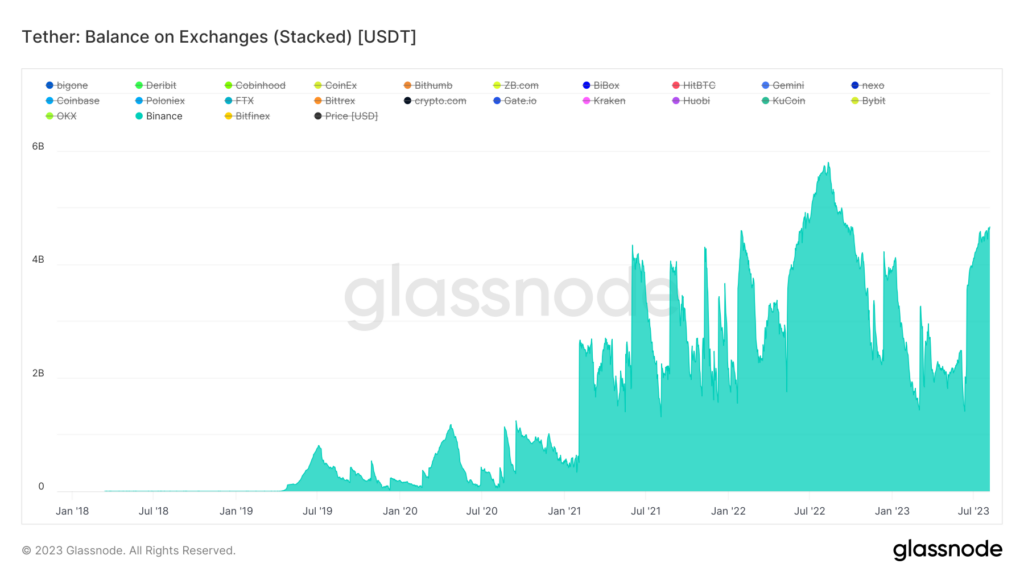

USDT reserves across exchanges

A closer examination reveals that Huobi’s situation may not be isolated. According to data from Glassnode, USDT reserves, on all chains, across most top exchanges, including Huobi, have depleted at a similar rate. This suggests that the concerns around Huobi might be part of a broader market trend rather than an issue specific to Huobi.

Interestingly, Binance stands as an outlier in this scenario. While other exchanges have seen a decrease in their USDT reserves, Binance has recorded an increase, according to Glassnode. This divergence highlights that Binance’s role and strategies in the current market environment are markedly different from other exchanges.

Concerns about Huobi’s solvency.

Adam Cochran, a partner at Cinneamhain Ventures, raised concerns over Huobi’s financial health in a post thread on X on Aug. 5.

Cochran’s allegations center around distributing and controlling USDT and USDC tokens within the Huobi platform. According to Cochran’s tweets on Aug. 5, Tron’s blockchain data suggests that 98% of the token is held directly by Sun or Huobi.

He further claims that when users’ stake’ their USDT into stUSDT, it gets swept into a Huobi deposit address, indicating a lack of transparency. Cochran alleges that Huobi holds only $90 million of assets across USDT and USDC, significantly smaller than the $630 million reported in Huobi’s ‘Merkle Tree Audit.’

Data from Glassnode confirms that Huobi holds $58 million in USDT as of press time.

While users believe they hold balances of $631 million in Huobi, Cochran posits that the actual amount is significantly less, with the shortfall being utilized by Justin Sun to bolster his other decentralized finance (DeFi) applications.

In addition to the alleged USDT discrepancy, Cochran suggests a parallel situation concerning Ethereum (ETH), where users’ holdings have been converted into stETH without their knowledge or consent.

As Cochran reported, “But it’s not just that. All the user ETH is also missing; Sun has turned it into stETH. All of it. Users think they hold 141,000 ETH on Huobi, and instead, Sun holds about half that total balance, and it’s all in stETH.”

This series of revelations has ignited controversy and speculation, leading to counter-claims from Huobi representatives.

A Huobi community manager, @33Huobi, retorted on Aug. 6, insisting that the police were investigating neither Huobi nor Tron and that all operations had been normal. Despite this, Cochran doubled down on his initial allegations, citing a senior executive from the Tron team as his source.

Amid this conflicting information, Cochran continued his analysis, reporting on Aug. 7 that Huobi’s total balance stood at $2.5 billion. He maintained that even the total liquid assets on the exchange were less than one-third of the reported amount of USDT obligations, further fueling insolvency rumors.

Cochran’s final tweet on Aug. 7 read, “Huobi denied the rumors” Yeah… did you expect Justin to be like, “Oh yeah, we’re insolvent?” People lie. Blockchains don’t. 🤷♂️”

While the truth behind Cochran’s allegations requires additional information and confirmation of certain accounts’ ownership, this situation serves as a crucial reminder of the importance of transparency and accountability within the crypto industry.

Despite these concerns, Huobi continues to reassure its users and the broader community of its operational stability. Xie Jiayin, Huobi PR, has reiterated that the platform’s operations are running as usual and requested the community to refrain from spreading or believing in rumors, according to FX168. Huobi’s spokesperson also urged further investigation into the information source to avoid FUD.

As of press time, Huobi had not responded to CryptoSlate’s requests for comment.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Aptos

Aptos  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  OKB

OKB  Render

Render  Immutable

Immutable  Renzo Restaked ETH

Renzo Restaked ETH  XT.com

XT.com  Pepe

Pepe  Bittensor

Bittensor  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Maker

Maker  Wrapped eETH

Wrapped eETH  The Graph

The Graph  Optimism

Optimism