Quick Take

- The options market is finally starting to price in the Ethereum Shanghai upgrade, supposedly scheduled for April 12.

- Options 25 delta skew at the front end (1 week to 1 Month) suggests bearish sentiment, with puts starting to dominate calls.

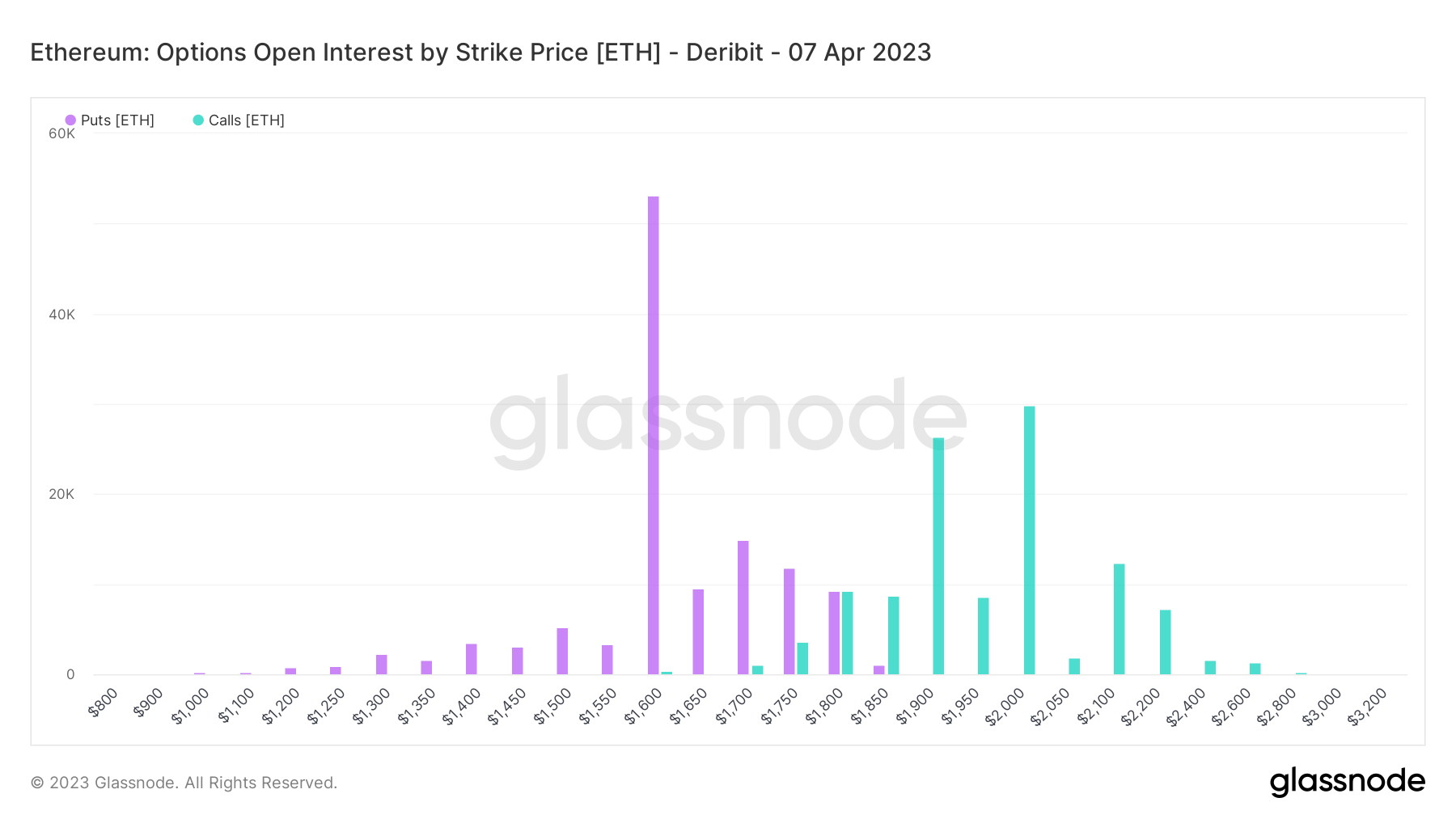

- Furthermore, looking at options open interest by strike price — an overwhelming amount of puts (50,000 ETH) calling for $1,600 for April 7.

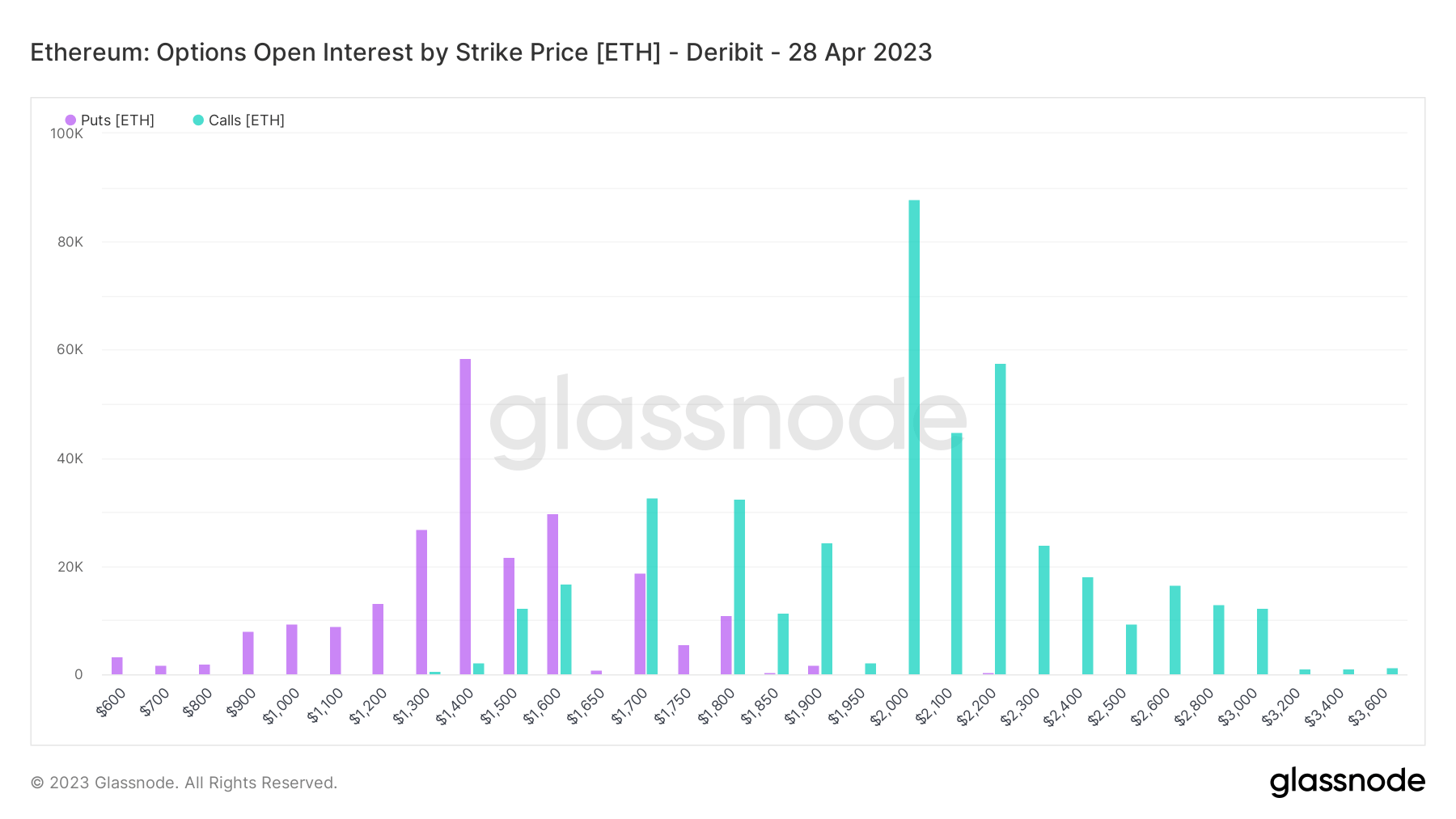

- However, on April 28, the options market is slightly bullish — with 90,000 ETH calls at $2,000.

- Negative sentiment towards Ethereum in the short term due to the potential of “unlocks.”

The post Investors wary as Shanghai upgrade looms, options market signals negative sentiment appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Aptos

Aptos  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  Render

Render  Immutable

Immutable  XT.com

XT.com  Pepe

Pepe  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  dogwifhat

dogwifhat  Optimism

Optimism  Wrapped eETH

Wrapped eETH  The Graph

The Graph