Quick Take

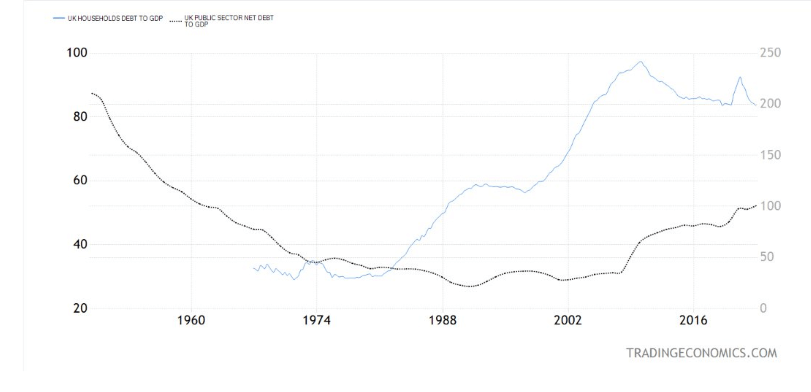

The United Kingdom is currently facing a challenging financial environment as its household and government debt levels rise alarmingly. Household debt has skyrocketed, reaching 200% of the country’s Gross Domestic Product (GDP), while the government debt has equally grown, constituting 100% of GDP. The impending threat of interest rate hikes makes these soaring debt levels potentially unsustainable.

As it stands, the Bank of England’s base interest rate is 5%. However, market analysts predict a significant chance – 50%, to be precise – that this rate could jump to 6.75% by early 2024. Such an increase would further elevate yields along the yield curve, exceeding the rates seen during the pension crisis of the past year.

Fueling this potentially volatile situation is the UK’s concerning inflation rate. The Consumer Price Index (CPI) inflation is currently at a notable 8.7%, with core inflation hitting 7.1%. These figures dramatically contrast the Bank of England’s previous rates of 1.75% and 0.25% from a year and a year and a half ago, respectively, highlighting the extent to which the Bank has lagged in its response.

With these financial storms brewing, the UK finds itself at a crucial economic juncture. The fallout from these economic stressors will likely influence the country’s fiscal health for the foreseeable future. In this climate of uncertainty, the Bank of England’s future actions and their impact on the nation’s economy are under intense scrutiny.

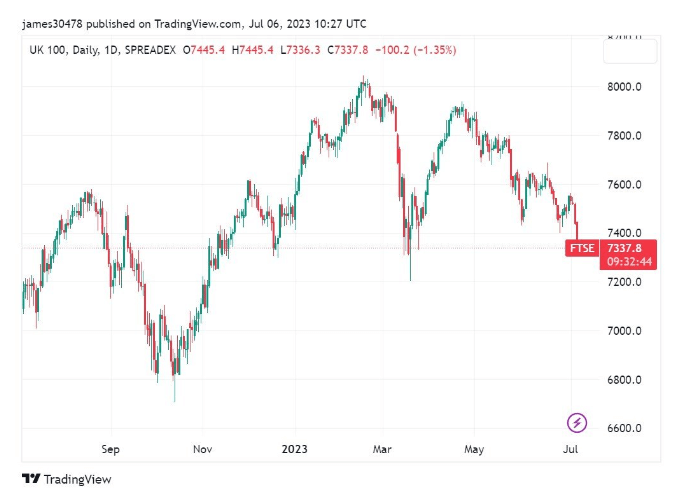

Moreover, the FTSE 100 index, representing the top 100 UK stocks, has hit a new low for the year, dropping to 7286, which is more than 2% down from the previous day.

The post Is the UK heading towards a sovereign debt crisis? appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  Fetch.ai

Fetch.ai  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Aptos

Aptos  First Digital USD

First Digital USD  Pepe

Pepe  Render

Render  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Mantle

Mantle  dogwifhat

dogwifhat  Stacks

Stacks  Filecoin

Filecoin  Immutable

Immutable  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  Optimism

Optimism  XT.com

XT.com  Bittensor

Bittensor  Arbitrum

Arbitrum  Maker

Maker  The Graph

The Graph