Quick Take

Understanding Bitcoin’s cycles is pivotal, and an intriguing way to capture this information is through an analysis of the total supply of Bitcoin held at loss by long-term holders. Long-term holders refer to investors who have retained Bitcoin in their portfolio for a period exceeding 155 days.

Currently, this figure sits at 2.6 million Bitcoin. Traditionally, as we emerge from bear markets and Bitcoin initiates its bull run, there have been instances where long-term holders have sustained this level of Bitcoin supply at a loss: 2016, 2019, and 2023. An exception was the COVID-induced segment of the cycle, which, due to its unpredictability, is excluded from this analysis.

It is observable that the lowest point in Bitcoin’s price cycle coincides with the period when long-term holders experience their most significant losses in terms of Bitcoin value.

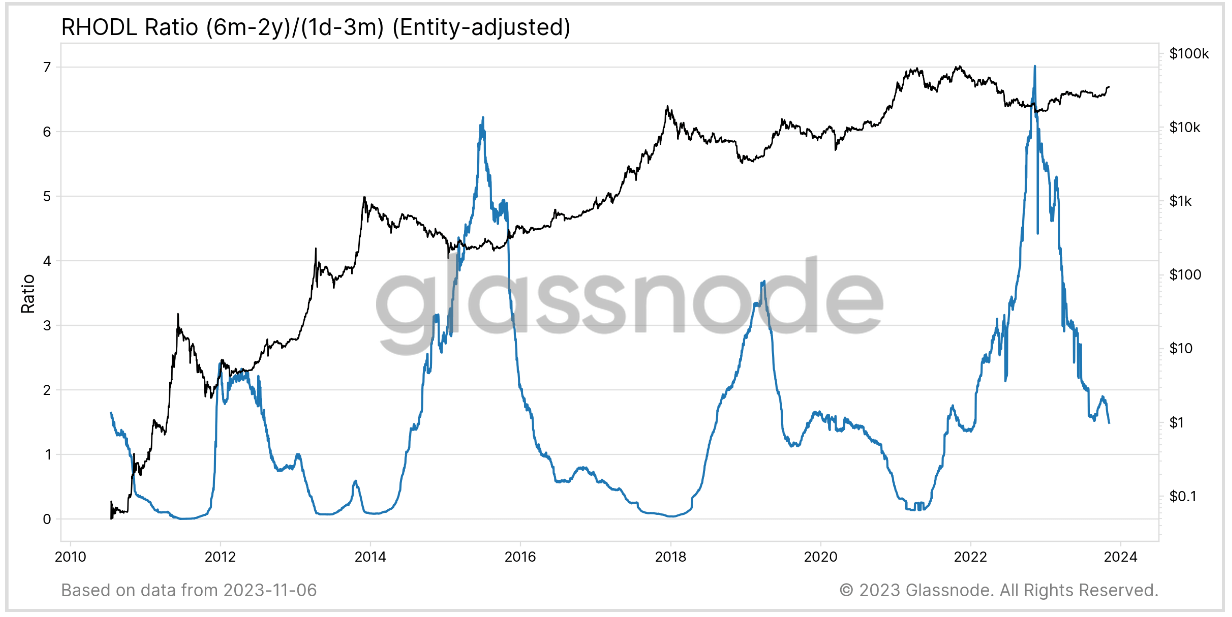

Further substantiating these trends is the RHODL ratio, a measure that contrasts the wealth held by single-cycle Long-Term Holders (6m-2y) against the newest Short-Term Holders (1d-3m). This ratio is used to identify the capital rotation turning point across cycle transitions.

Once again, it’s evident that the peak of the RHODL ratio aligns with the nadir of Bitcoin’s price cycle. As we ascend from the market bottom, the RHODL ratio initiates its transition, a shift that commenced in early 2023.

As per the current data, we are still amidst this transition phase in the cycle, potentially heading towards a bull market, a pattern that is consistent with previous cycles.

The post Long-term holder trends suggest crypto markets could be headed for a bull run appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Fetch.ai

Fetch.ai  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Render

Render  Hedera

Hedera  First Digital USD

First Digital USD  Aptos

Aptos  Cosmos Hub

Cosmos Hub  Mantle

Mantle  Cronos

Cronos  Pepe

Pepe  Filecoin

Filecoin  Immutable

Immutable  Stacks

Stacks  Wrapped eETH

Wrapped eETH  Stellar

Stellar  XT.com

XT.com  OKB

OKB  Renzo Restaked ETH

Renzo Restaked ETH  dogwifhat

dogwifhat  Bittensor

Bittensor  Optimism

Optimism  Arbitrum

Arbitrum  The Graph

The Graph  Maker

Maker