Global digital asset investment products saw significant inflows last week, totaling $2.45 billion.

The latest weekly report from CoinShares confirmed the surge in the inflow of funds into digital asset investment products, which pushed the assets under management to a peak not seen since early 2022, now standing at $67 billion. The US spot ETF market played a pivotal role in this development, capturing $2.4 billion of last week’s inflows.

Bitcoin remains the clear market leader, garnering approximately 98% of total inflows last week. Increased confidence also permeated through to Ethereum, receiving inflows of $21 million. Altcoins such as Litecoin and XRP saw minor yet sustained inflows throughout the period.

The report also sheds light on the regional trends of these inflows. While the US leads, other regions have shown mixed reactions. Switzerland and Germany, for instance, reported $16.7 million and $13.3 million in inflows, respectively, contrasting with outflows from Canada and Sweden. This geographical distribution of inflows and outflows highlights the nuanced global perspective on digital asset investments.

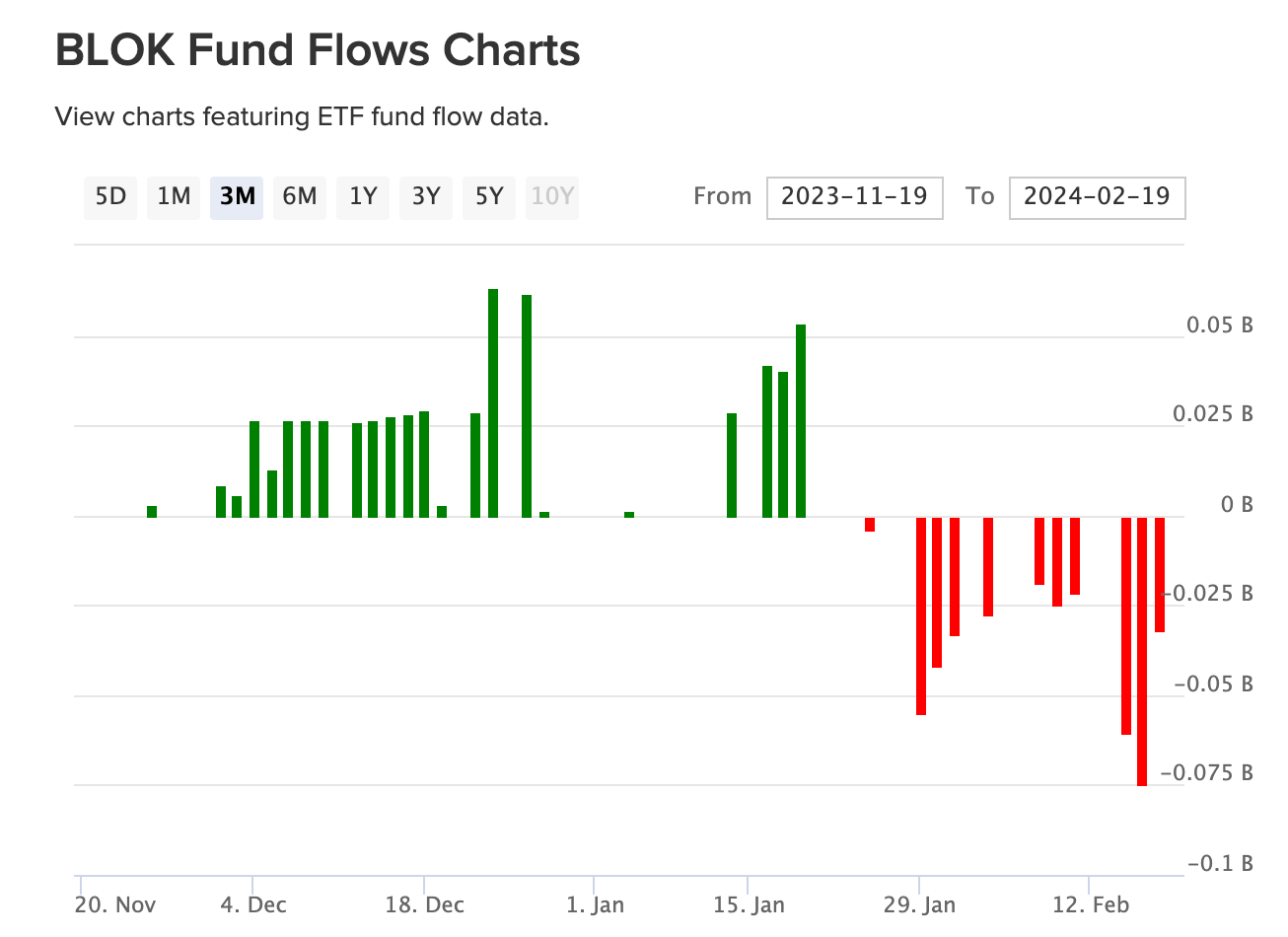

The overall trend in digital asset investment products is positive. Blockchain equities, however, experienced a mixed bag, with a notable outflow from Amplify Transformational Data Sharing ETF (BLOK) totaling $171 million, while others saw collective net inflows of $4 million. This contrast illustrates the varied investor sentiment and strategies at play within the broader crypto and blockchain investment landscape. According to the VettaFi ETF Database, BLOK has seen persistent outflows since mid-January.

In summary, the latest CoinShares report emphasizes a robust influx of capital into digital asset investment products, with a continued concentration on Bitcoin. The significant inflows, the highest AuM since the December 2021 peak, and the regional variations in investment flow reflect the growing maturity and complexity of the crypto investment space.

Correction: Updated AuM which missed latest inflows.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  Immutable

Immutable  Render

Render  Pepe

Pepe  XT.com

XT.com  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  Optimism

Optimism  dogwifhat

dogwifhat  Wrapped eETH

Wrapped eETH  The Graph

The Graph