- Solana’s NFT ecosystem witnessed growth over the last week

- Market indicators revealed an ongoing battle between the bulls and the bears

Solana Daily, a Twitter account that posts updates related to the Solana [SOL] ecosystem, recently revealed the developments that happened in Solana’s NFT marketplace over the past week.

For instance, Magic Eden launched its new Open Creator Protocol (OCP). It is a no-code solution that would enrich the utility of a token and personalize token actions.

Solana NFTs Highlights (Week 50)

🔸@MagicEden launched Open Creator Protocol (OCP)

🔸MagicEden partnered with @stripe

🔸@metaplex Royalties Update

🔸@Stepnofficial Genesis Shoebox Giveaway

🔸@DegenerateNews will be the first to mint on Magic Eden’s launchpad#SolanaNFTs @solana pic.twitter.com/cehRVZFLSP— Solana Daily (@solana_daily) December 10, 2022

Read Solana’s [SOL] Price Prediction 2023-2024

Additionally, Magic Eden partnered with Stripe to help the community trade NFTs more easily. Interestingly, Magic Eden also topped the list of the top Solana Marketplaces in user growth last month. Mean Dao and Saber Labs completed the top 3.

Top Solana Marketplaces with the Users Growth Last Month@MagicEden@meanfinance@Saber_HQ@rarible@raydiumprotocol@MercurialFi@solendprotocol@dappradar #Solana #NFT $SOL pic.twitter.com/LEfoBsXo3l

— Solana Daily (@solana_daily) December 9, 2022

More good news!

Santiment’s data revealed that apart from the aforementioned developments, Solana’s NFT ecosystem also witnessed growth in terms of volume. Its total NFT trade count and total NFT trade volume in USD spiked last week.

Source: Santiment

As per DeFiLlama’s data, Solana’s total value locked (TVL) also registered an increase over the last two days. Interestingly, Solana ranked fourth on the list of top projects in terms of TVL.

⚡️Top Projects by Total Staked Value

9 December 2022#Ethereum $ETH #ETH $ADA #BNBChain $BNB #BNB $SOL #Avalanche $AVAX #AVAX $DOT $MATIC #TRON $TRX #TRX $ATOM $ICP $CAKE $ALGO $NEAR #NEAR $FLOW $EGLDSource: @StakingRewards pic.twitter.com/iOEBu65L4p

— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) December 9, 2022

Solana recently announced the launch of DVT-1, Saga’s developer unit program, and gave early access to a limited group of developers. The new program allowed developers access to an early, pre-production version of Saga so that they may build, test, and refine it on actual hardware.

Calling all developers!

We are launching DVT-1, Saga’s developer unit program, and giving early access to a limited group of developers

If you are committed to building the future of Web3 on mobile, join us and build

Reserve your DVT-1 at https://t.co/QigYQjmxgn

1/ of 🧵 pic.twitter.com/81sh9qeFVj

— Solana Mobile (@solanamobile) December 9, 2022

All these developments looked promising for the blockchain and had the potential to fuel a new bull run.

What should Solana investors expect?

However, things didn’t turn out to be favorable for Solana in terms of its performance on the chart. SOL failed to please its investors as it merely registered over 1% in weekly gains.

As per CoinMarketCap, at press time, SOL was trading at $13.64 with a market capitalization of more than $4.99 billion.

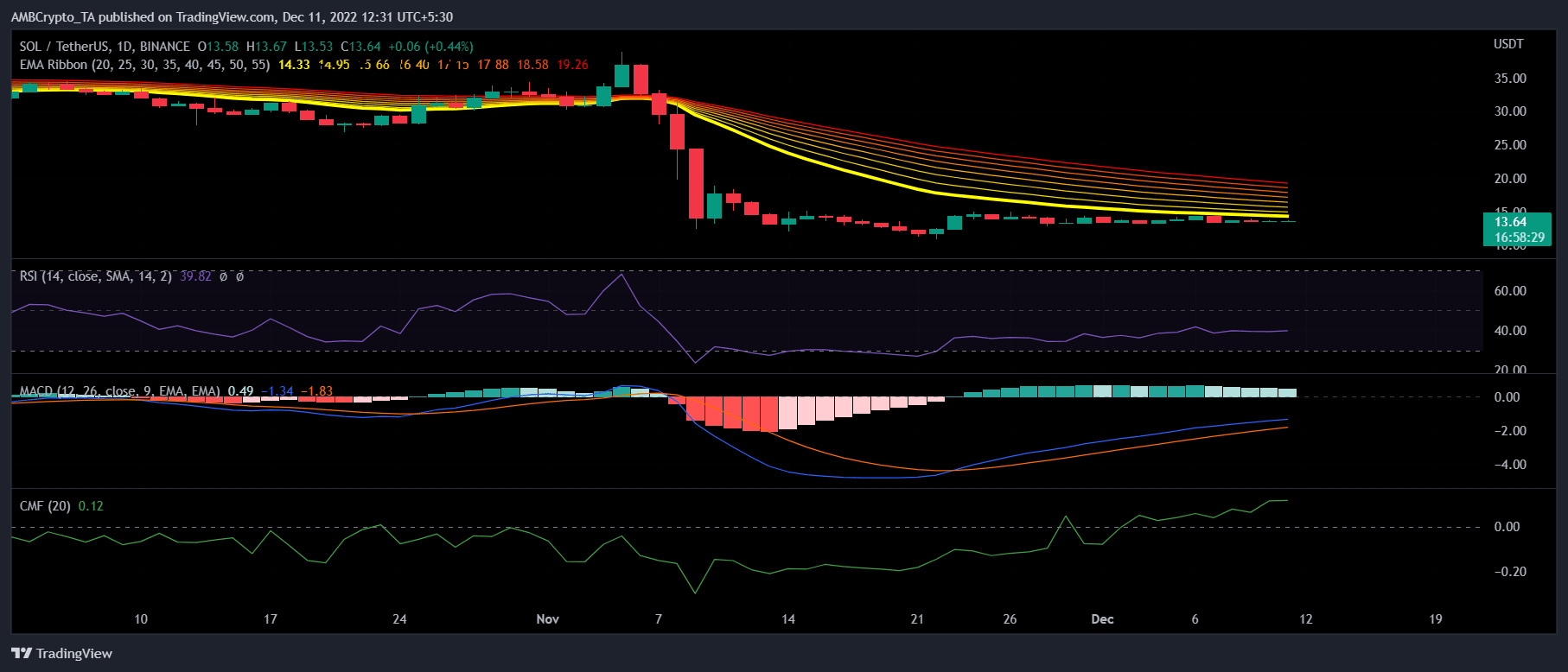

A look at SOL’s daily chart painted an ambiguous picture. A few market indicators were in favor of SOL while others suggested a price plummet. The Exponential Moving Average (EMA) Ribbon, for example, revealed sellers’ market advantage. The Relative Strength Index (RSI) was also resting below the neutral mark, which was a bearish signal.

Nonetheless, the Moving Average Convergence Divergence (MACD) registered a bullish crossover, giving investors hope for a price surge in the coming days. The Chaikin Money Flow (CMF) was also relatively up, which was a positive sign.

Source: TradingView

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Aptos

Aptos  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  Render

Render  Immutable

Immutable  XT.com

XT.com  Pepe

Pepe  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  dogwifhat

dogwifhat  Optimism

Optimism  Wrapped eETH

Wrapped eETH  The Graph

The Graph