A recent report by Business Insider revealed that Taylor Swift pulled out of a $100 million sponsorship deal with Sam Bankman-Fried and his crypto exchange, FTX. The popular singer was the only celebrity to question the crypto exchange’s compliance with regulations regarding unregistered securities.

The information was disclosed by Adam Moskowitz, the lawyer handling a class-action lawsuit against several FTX promoters, including Shaquille O’Neal, Tom Brady, and Larry David. Moskowitz disclosed that the plaintiffs seek over $5 billion from FTX’s celebrity endorsers.

The FTX Crypto Debacle Continues To Reverberate

The complaint against FTX executives, filed by the Securities and Exchange Commission (SEC) in December 2022, alleged that FTX’s cryptocurrency, FTT, was sold as an investment contract and was not appropriately registered as a security with the SEC. The lawsuit filed by Moskowitz seeks to recover damages for customers who lost money due to investing in FTX.

However, while several celebrities endorsed FTX, Moskowitz revealed that Taylor Swift was the only celebrity to question the compliance of the crypto exchange with regulations regarding unregistered securities. Moskowitz praised Swift for her diligence in reviewing the proposed sponsorship deal and for refusing to compromise on the issue of unregistered securities.

Per the report, the plaintiffs claim that the celebrity endorsers of FTX misled people by promoting the exchange without disclosing important risks associated with investing in the crypto market. This includes that FTX was not registered with the Securities and Exchange Commission (SEC) and allegedly failed to comply with regulations regarding unregistered securities.

The terms of the proposed deal included selling tickets as non-fungible tokens (NFTs), a move considered risky by FTX’s marketing staff, who thought the deal was too expensive from the beginning.

Furthermore, Moskowitz added that during discovery, Swift asked FTX to confirm that the proposed securities were not unregistered, demonstrating her understanding of the risks associated with investing in the crypto market.

SEC Chair Blames Bank Failures On Crypto

Gary Gensler, the Chair of the Securities and Exchange Commission, recently made headlines when he spoke before Congress about the failures of three banks: Silvergate Bank, Silicon Valley Bank, and Signature Bank. Gensler suggested that the bank’s involvement in the crypto industry may have contributed to their failures during his testimony.

For this, Minnesota Congressman Tom Emmer criticized Gary Gensler for his “regulation by enforcement” approach to digital assets. During a House Financial Services Committee hearing, Emmer accused Gensler of failing to protect investors while pushing valuable financial innovation overseas.

Furthermore, lawyer John Deaton also sparked a debate about classifying tokens as securities in a recent tweet. Deaton argued that the SEC Chair claiming a token is always a security is an unconstitutional shortcut that avoids the need to perform a Howey analysis and that W.J. Howey himself would never support such a claim.

The Howey Test, established by the Supreme Court in 1946, determines whether an investment contract or asset is a security. The test defines an investment contract as a contract, transaction, or scheme in which a person invests money in a common enterprise and is led to expect profits solely from the efforts of others.

The debate around classifying tokens as securities have been ongoing for years and have significant implications for the crypto industry.

However, It is crucial to recognize that the industry and its various applications offer another solution to the financial crisis that the world has been experiencing. In this sense, digital assets can be considered a financial haven for investors who can rely on them to safeguard their savings.

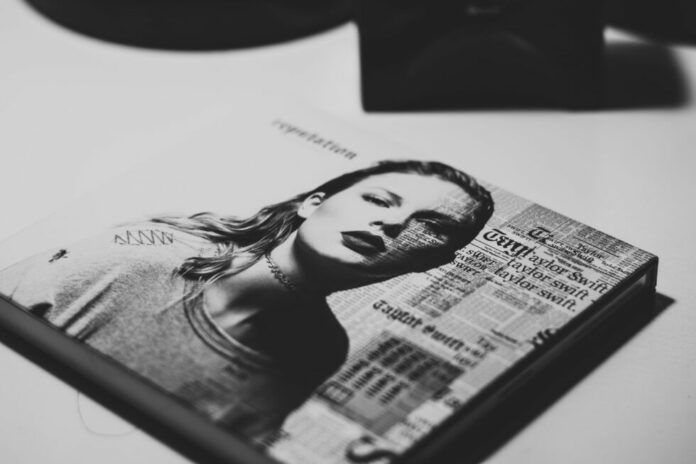

Featured image from Unsplash, chart from TradingView.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  Fetch.ai

Fetch.ai  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Aptos

Aptos  First Digital USD

First Digital USD  Pepe

Pepe  Render

Render  Cronos

Cronos  dogwifhat

dogwifhat  Cosmos Hub

Cosmos Hub  Mantle

Mantle  Stacks

Stacks  Filecoin

Filecoin  Immutable

Immutable  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  XT.com

XT.com  Optimism

Optimism  Bittensor

Bittensor  Arbitrum

Arbitrum  Maker

Maker  The Graph

The Graph