Tether, the issuer of USDT, the world’s largest stablecoin, has minted the second 1 billion token on the Ethereum blockchain in less than two months.

The stablecoin issuer has said that the new mint is part of its “inventory replenish” program to ensure stablecoin liquidity across all chains. In other crypto developments, Tradecurve has been building momentum as investors flock to the new trading platform that has the potential to rekindle interest in the DeFi space.

Tether Mints Additional 1 Billion USDT

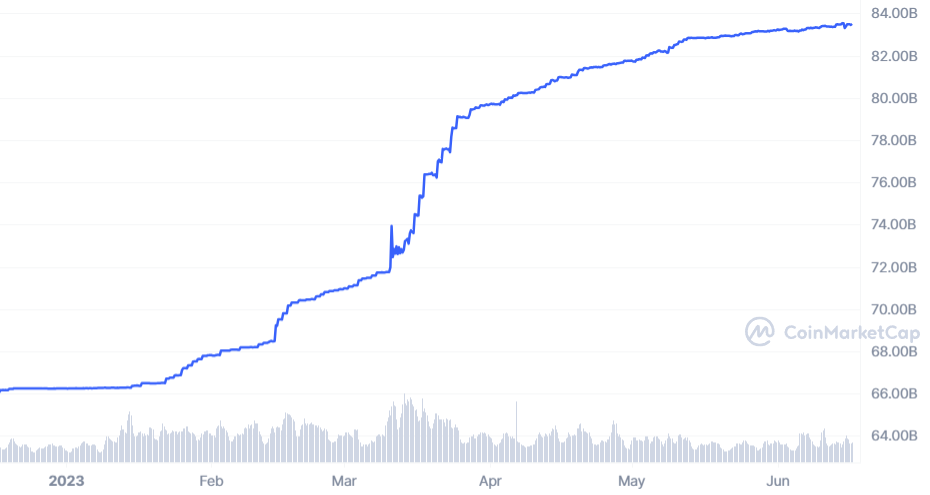

Tether’s treasury has announced the minting of 1 billion USDT tokens on the Ethereum blockchain just two months after a separate 1 billion USDT token was minted. So far in 2023, the stablecoin issuer has now minted over $16 billion worth of USDT tokens. Tether remains the most dominant USD-pegged stablecoin with a market cap of $83 billion.

Announcing the latest mint, Tether’s CTO Paolo Ardoino, explained that the tokens were minted for chain swap and not due to a rising interest in the purchase of digital assets. Chain swap refers to the process of sending digital assets (in this case USDT) from one blockchain network to another – bridging assets across multiple blockchains.

After the mint, on-chain data showed that Tether’s Treasury sent $750 million worth of USDT in a chain swap transaction to Binance. According to Arkham Intelligence, the popular blockchain analytical firm, the Tether Treasury sent the funds in three separate batches of $250 million transactions after an initial $10 test transaction.

The analytical firm later reported that of the $1 billion new tokens minted, only $146 million remains on the Ethereum blockchain as the others have been swapped for USDT on other chains.

Tradecurve (TCRV) Price Set to Hit $0.018

Along with the increasing dominance of Tether in the stablecoin sectors, Tradecurve has enjoyed increasing attention in the decentralized finance (DeFi) space. Tradecurve is building the first DeFi platform where its users will have the opportunity to trade both cryptocurrencies and derivatives (like stocks, forex, options, and commodities) from a single account.

Experts are bullish that the price of Tradecurve (TCRV) could easily jump above its current $0.018 price because of the magnitude of the derivatives markets. The Bank for International Settlements reports that in June 2022, the over-the-counter (OTC) derivatives market rose to $632 trillion.

The bullish predictions for the price of Tradecurve come from the platform’s potential to connect the crypto market with the global derivatives market.

Experts believe the Tradecurve platform could rekindle interest in the DeFi space as crypto traders would no longer need to open more than one account to trade global financial instruments. As more traders enter into the Tradecurve ecosystem, experts predict that the price of TCRV could jump from $0.018 to as high as $1.5 by the end of 2023.

For more information about the Tradecurve presale:

Click Here For Website

Click Here To Buy TCRV Presale Tokens

Join Our Community on Telegram

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Fetch.ai

Fetch.ai  Uniswap

Uniswap  Dai

Dai  LEO Token

LEO Token  Render

Render  Ethereum Classic

Ethereum Classic  Hedera

Hedera  First Digital USD

First Digital USD  Aptos

Aptos  Cosmos Hub

Cosmos Hub  Pepe

Pepe  Cronos

Cronos  Mantle

Mantle  Filecoin

Filecoin  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Immutable

Immutable  Renzo Restaked ETH

Renzo Restaked ETH  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Optimism

Optimism  Bittensor

Bittensor  Arweave

Arweave  The Graph

The Graph