Quick Take

- Due to the economy being built on credit, both growth, and expansion are necessities. As such, central banks’ biggest fear is deflation and stagflation. Take the U.K. as an example — though this can be attributed to many Western countries.

Three metrics that contribute to stagflation;

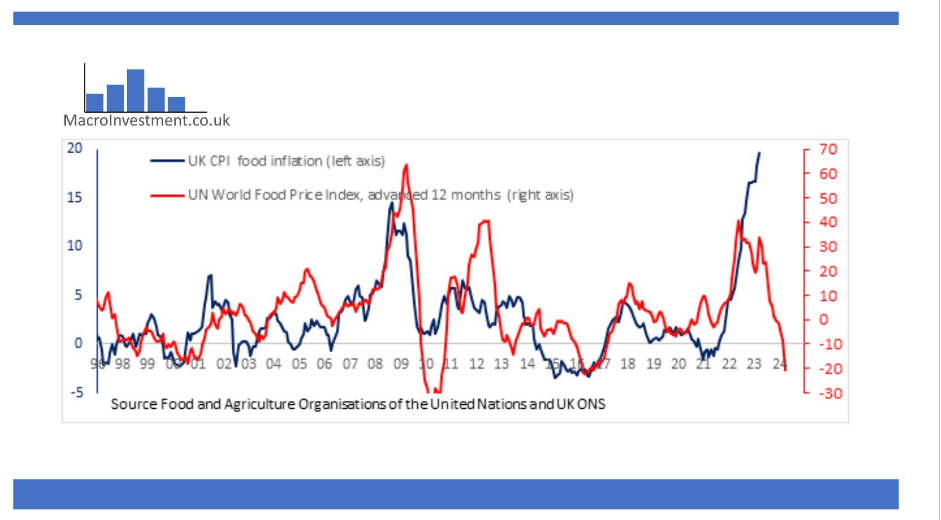

- Persistent high inflation: Inflation has been higher than the CPI goal of 2% for over a year now, and the biggest worry for central banks is entrenched inflation. For example, in the U.K., CPI Inflation has been double digits for almost a year — while core inflation has been as high as 6% for over a year.

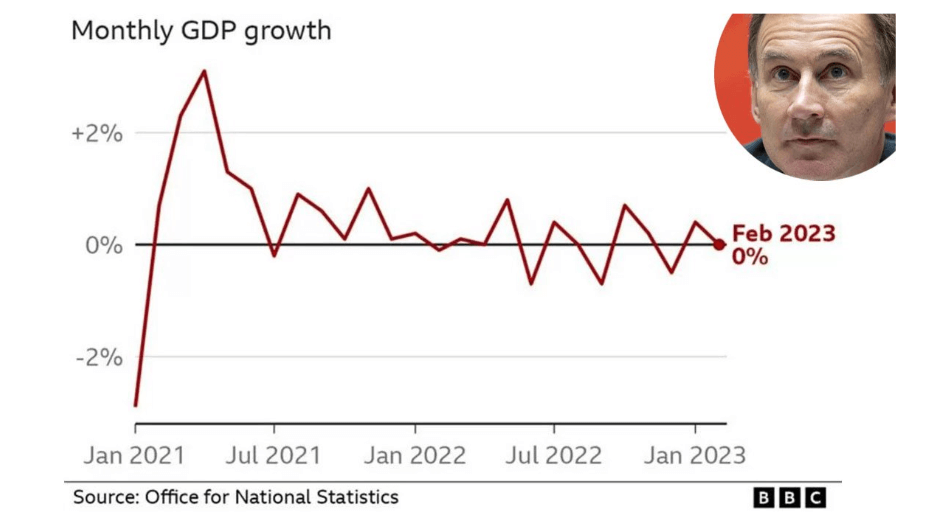

- Stagnant demand in a country’s economy: U.K. real GDP is still below Q4 2019.

- High unemployment: We aren’t here yet, but the U.K. unemployment rate did spike from 3.7% to 3.8%. As interest rates continue to rise and stay elevated, this will further pressure the labor market.

Stagflation was last seen in the 1970s, and consumer good prices tend to rise — while asset prices tend to deflate. Central banks are getting caught between a rock and a hard place.

CryptoSlate previously covered an insight into asset prices between the 1970s and the 2020s.

The post The central banks’ dilemma: inflation, stagflation, and the cryptocurrency response in today’s economy appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  Fetch.ai

Fetch.ai  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  First Digital USD

First Digital USD  Pepe

Pepe  Cronos

Cronos  Stacks

Stacks  Mantle

Mantle  Cosmos Hub

Cosmos Hub  dogwifhat

dogwifhat  Filecoin

Filecoin  Render

Render  Immutable

Immutable  Stellar

Stellar  XT.com

XT.com  Optimism

Optimism  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  Bittensor

Bittensor  Arbitrum

Arbitrum  Wrapped eETH

Wrapped eETH  Maker

Maker  The Graph

The Graph