U.S. inflation is coming down

This past week, the highlight of the macro releases is certainly U.S. inflation data. The Fed has been raising rates for over a year, and we are starting to see signs of disinflation, but it is too early for the Fed to declare victory.

CPI inflation fell below expectations for February; over the year, inflation slowed to 5% from 6%, the largest single drop in inflation this cycle. At the same time, energy is in deflation for the first time since 2021 (-0.5%). Does this echo the OPEC + announcement cuts that economic demand is deteriorating?

On the other hand, we have seen a 32% decline in the oil price (YOY), and CPI inflation is only 5%. This is the first time ever oil is down over 15% while CPI stays above 5%.

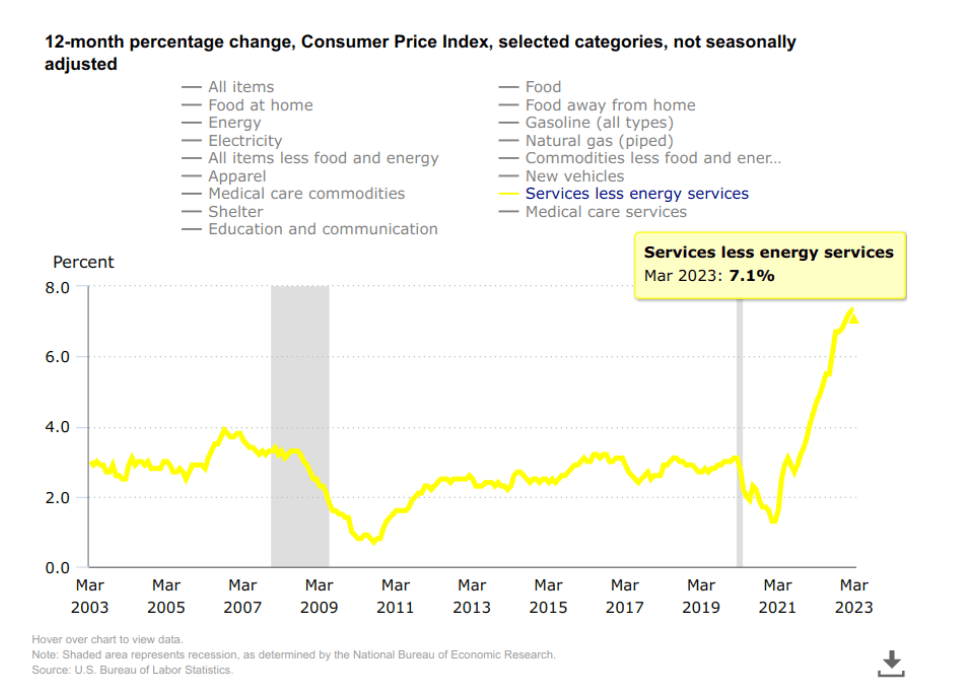

Furthermore, core inflation remains sticky, with services inflation still above 7%, which remains too high for the feds liking. Core CPI increased from +0.1% to 5.6% y/y. The fed must continue on a hawkish path to avoid the mistakes of the 70s and 80s. However, credit uncertainty will play a huge factor in the short to medium term.

Fed Minutes

Minutes of the last FOMC came out after the Wednesday CPI print, revealing a couple of factors. One is staff projected a “mild recession” later this year. While “all” officials backed the 25bps rate hike last month. The FOMC maintains both reducing inflation while observing monetary policy closely.

China and Russia see inflation drop too

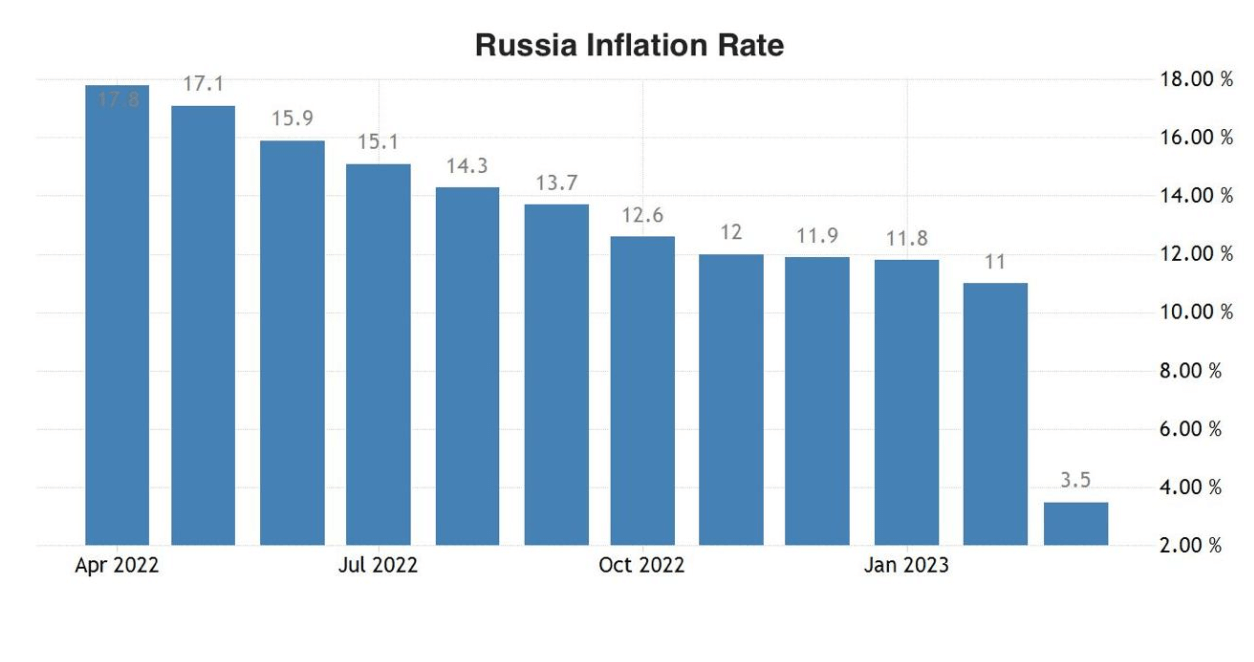

Russia’s inflation slowed to 3.5% from double digits of roughly 11% in February, reaching the lowest level in almost three years.

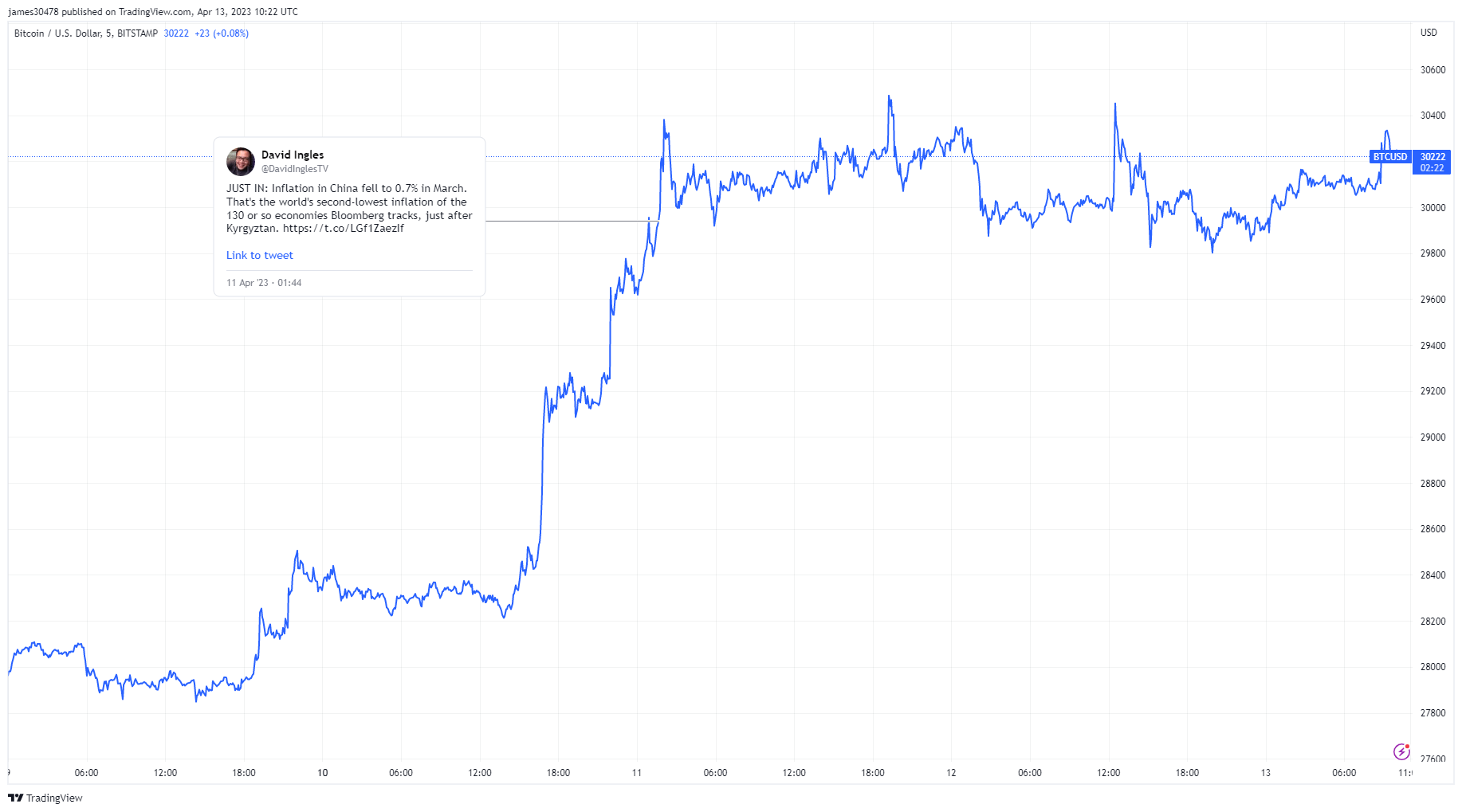

While China’s inflation dropped earlier in the week, PPI saw deflation, while CPI saw a reduction to 0.7%, which happened at a similar time as Bitcoin, exceeding $30,000 during Asia trading hours.

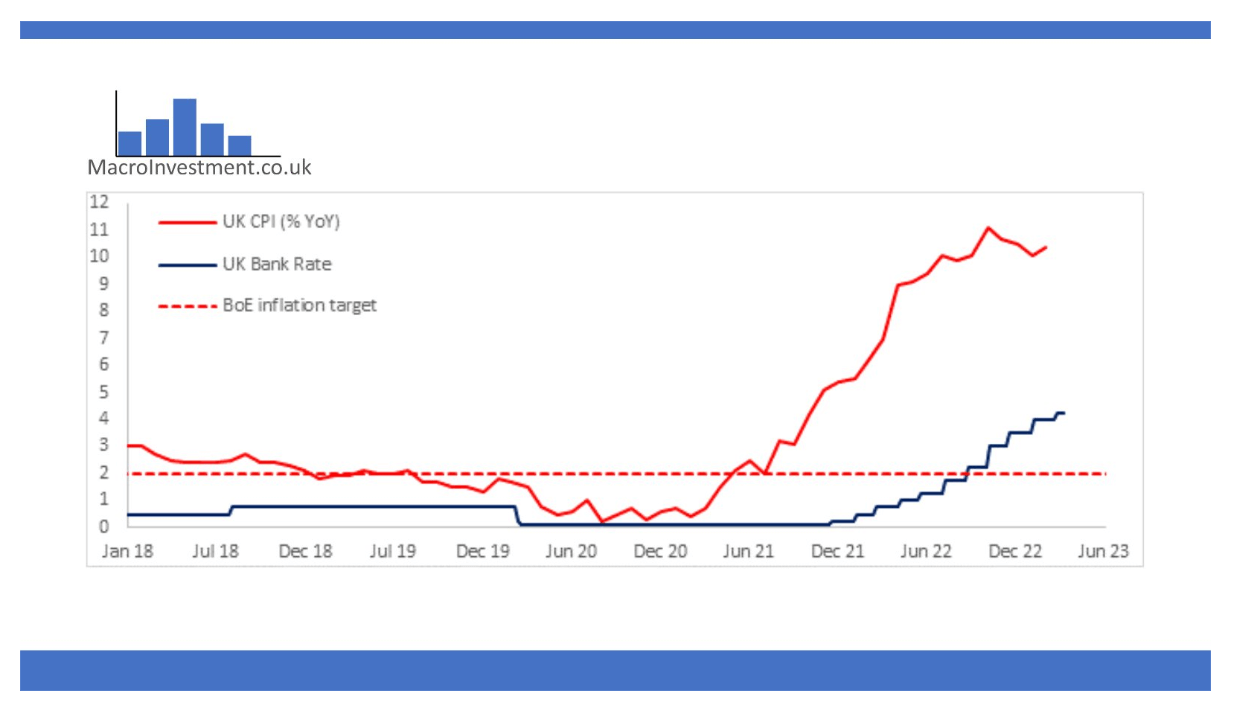

BOE tries and reign in hot inflation

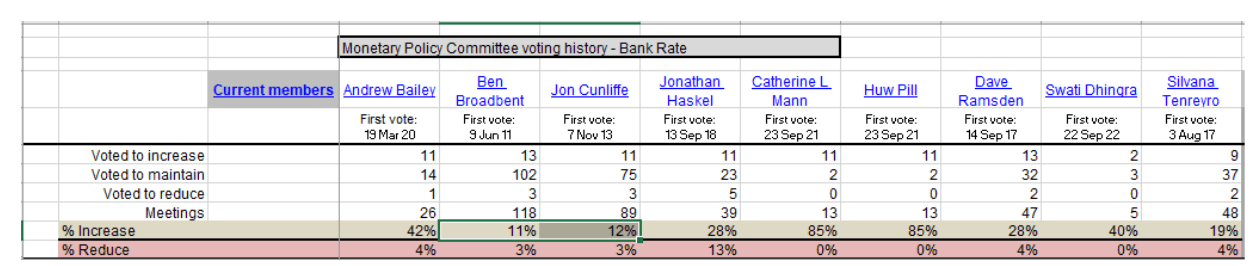

Andrew Bailey spoke at the IMF meeting about his outlook on prioritizing inflation. The BOE has raised eleven times, bringing the bank rate to 4.25%, and is expected to raise another 25bps on May 11. The UK currently has the highest inflation out of the G7, but in a turn of events, SIlvana Tenreryo was replaced.

She was the most dovish MPC member and has voted against every hike since September. Megan Greene is her replacement, who later said, “Bank of England will end up having to hike more to bring inflation back in line with their target”.

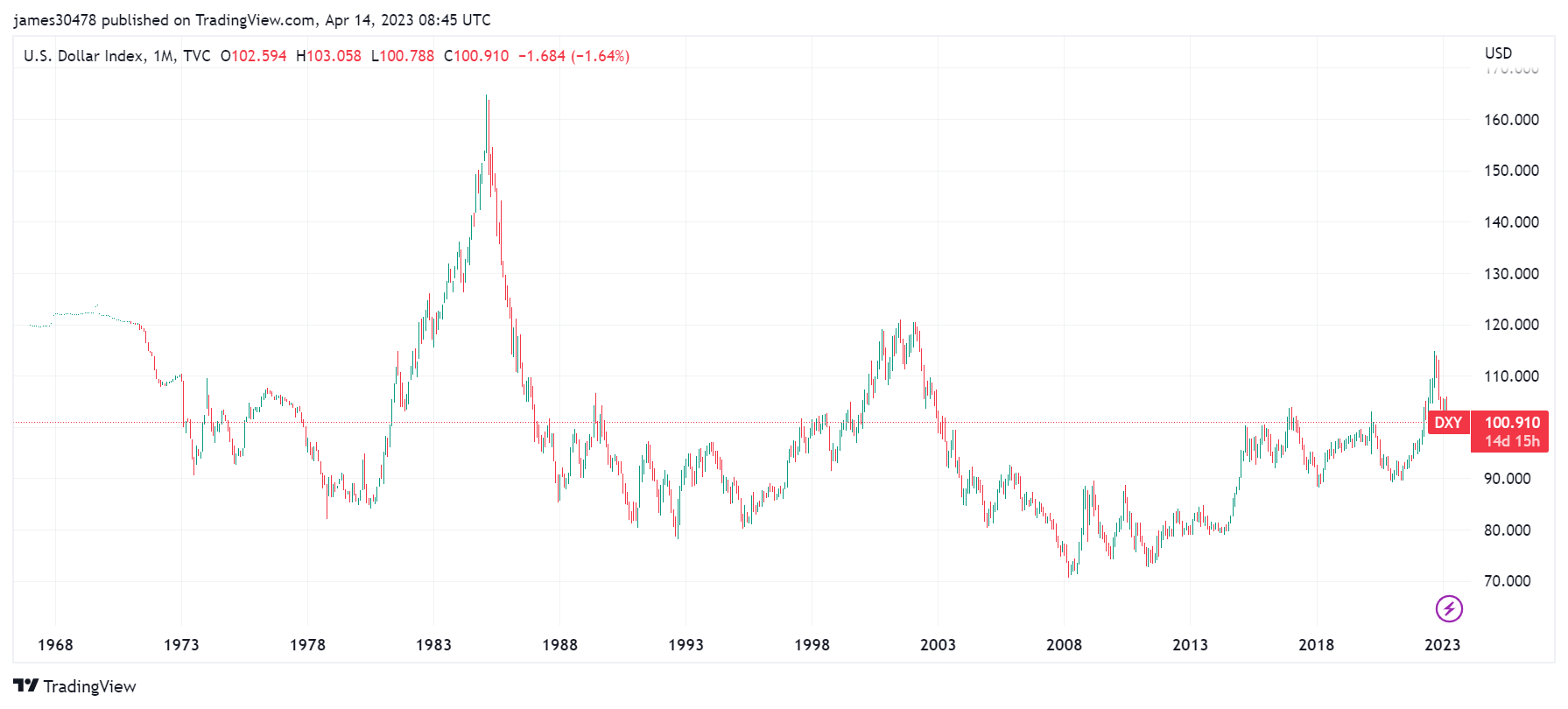

Sinking DXY, banking fears subsided

The DXY index sank to its lowest level in over a year, below 101, almost exactly where it was a year ago. Usually, during times of crisis, investors flock to the dollar because it is the world’s reserve currency. As you can see, during times of recession, the DXY index spikes as investors have to sell and cover their obligations for dollars.

The DXY index has dropped from 114 to 100; in the past few weeks as the banking crisis has subsided, we are approaching the end of the rate hiking schedule, and the potential of further de-dollarization echoes continues. But this is most certainly not the end of the dollar.

As credit and M2 contract further, we may see defaults, outright deflation, and unemployment. We then expect to see the DXY run again and assets get crushed.

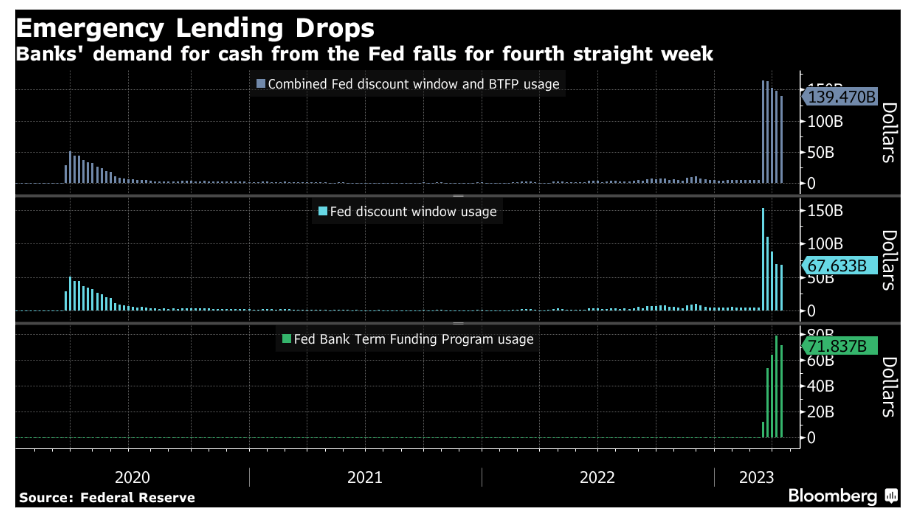

The banking crisis has subsided, while the Fed emergency lending programs dropped to $139.5 billion from $148.7 billion last week. Broken down by; Discount Window: $67.6B v $69.7 prior week, while BTFP: $71.8B v $79B. As a result, the fed balance sheet has shrunk slightly this week.

The post Weekly MacroSlate: U.S. inflation comes down, but Fed forecasts ‘mild recession’ appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Aptos

Aptos  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Filecoin

Filecoin  Render

Render  Cosmos Hub

Cosmos Hub  Pepe

Pepe  OKB

OKB  Renzo Restaked ETH

Renzo Restaked ETH  Immutable

Immutable  dogwifhat

dogwifhat  XT.com

XT.com  Bittensor

Bittensor  Arbitrum

Arbitrum  Maker

Maker  Wrapped eETH

Wrapped eETH  The Graph

The Graph  Optimism

Optimism