Quick Take

With Ethereum’s Shapella upgrade due in a matter of hours, the market is ripe with speculation about its effects on ETH’s price.

The Shapella upgrade is a combined name for two upgrades – the Shanghai upgrade, implementing changes to Ethereum’s execution layer, and the Capella upgrade, implementing changes to Ethereum’s consensus layer.

Among several minor upgrades to gas fees, Shapella’s significance lies in its ability to allow users and validators to access their staked ETH.

Validators will have two options when it comes to withdrawing their staked ETH — partial and full.

Partial withdrawal

The Shanghai upgrade allows validators to withdraw only a portion of their ETH stake and reduce their validator balance to the required 32 ETH.

The excess balance that can be partially withdrawn is roughly 1.137 million ETH, worth around $2.1 billion at press time. This is the excess validator balance that isn’t required to participate in Ethereum’s Proof-of-Stake consensus mechanism.

However, only validators with a withdrawal credential oxo1 are able to partially withdraw their stake. CryptoSlate analysis showed that this is roughly 44% of validators able to withdraw around 276,000 ETH.

Full withdrawal

Full withdrawals involve closing the entire validator down in order to recover the stake balance.

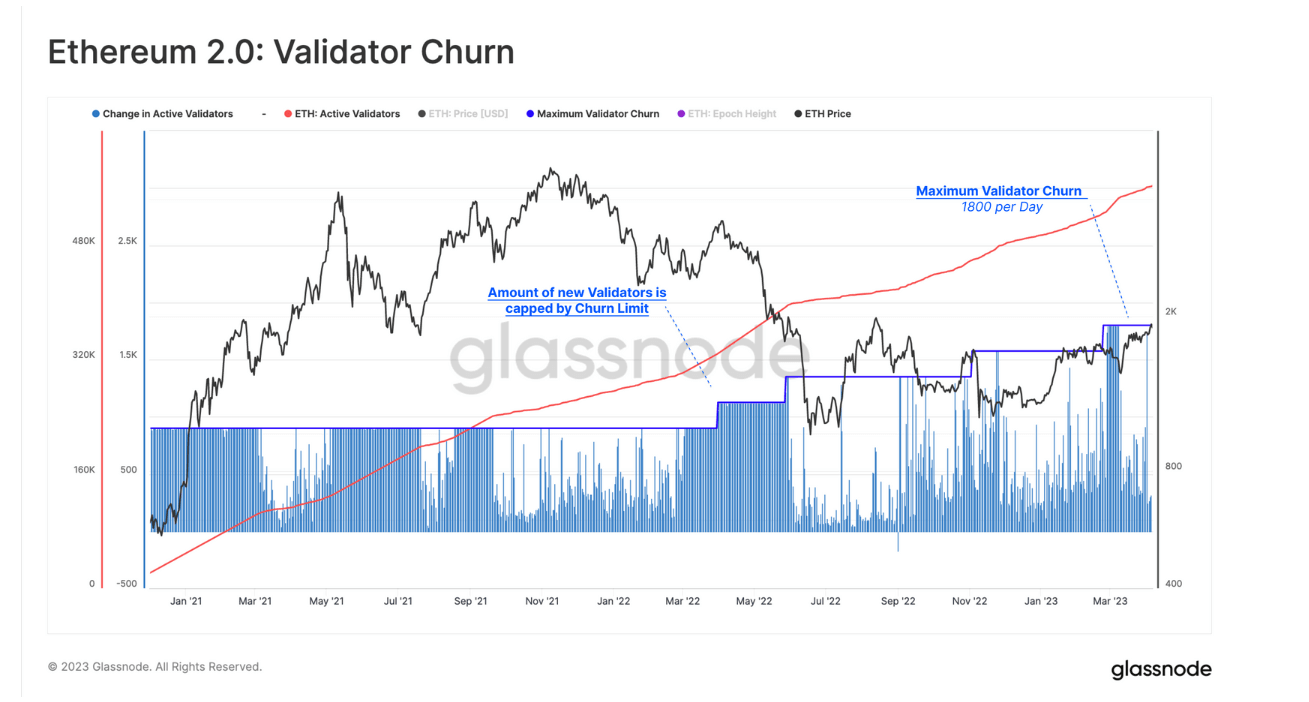

As the Ethereum network depends on a stable set of validators, only a maximum of 1,800 validators can be fully withdrawn daily. The limit is based on a churn specification of 8 validators per epoch, for 225 epochs per day.

This mechanism allows up to 57,600 ETH, worth around $109 million at press time, to fully withdraw per day.

According to the latest estimates from Glassnode, around 170,000 ETH, worth $323 million at press time, could be sold in the days following the Shanghai upgrade. Glassnode’s worst-case scenario sees a maximum of 1.54 million ETH that could be sold this week, worth just over $2.93 billion.

The post Worst-case scenario could see up to 1.54M ETH becoming liquid after Shanghai upgrade appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Renzo Restaked ETH

Renzo Restaked ETH  Pepe

Pepe  OKB

OKB  Render

Render  Immutable

Immutable  XT.com

XT.com  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  Optimism

Optimism  dogwifhat

dogwifhat  Wrapped eETH

Wrapped eETH  The Graph

The Graph