Bitcoin’s sustained price level above $30,000 has Brough about a noticeable shift in market behavior, particularly among short-term holders.

Short-term holders (STHs), or those who have held Bitcoin for less than 155 days, play a crucial role in market analysis. Their behavior often provides insights into market sentiment and potential price movements.

Typically, they are more reactive to price changes and tend to buy or sell based on recent market trends. This can lead to increased volatility, as their trading activities can cause sharp price swings.

For instance, when short-term holders start to hodl, it can reduce the sell-side pressure in the market, potentially leading to a more stable price environment.

The recent surge in Bitcoin’s price from $26,000 to over $30,000 has put the majority of STHs in profit. This is evident through the Short-Term Holder Spent Output Profit Ratio (STH-SOPR) metric. SOPR is a metric that calculates the profit ratio of coins moved on-chain, providing insights into whether holders are selling at a profit or loss. STH-SOPR focuses explicitly on short-term holders.

Since June 20, STH-SOPR has trended above 1, indicating that short-term holders are, on average, moving their coins at a profit. The metric peaked at 1.033 on June 21 and has since trended downwards, reaching 1.006 on July 11. This suggests that while STHs are still profiting, the profit margin has decreased.

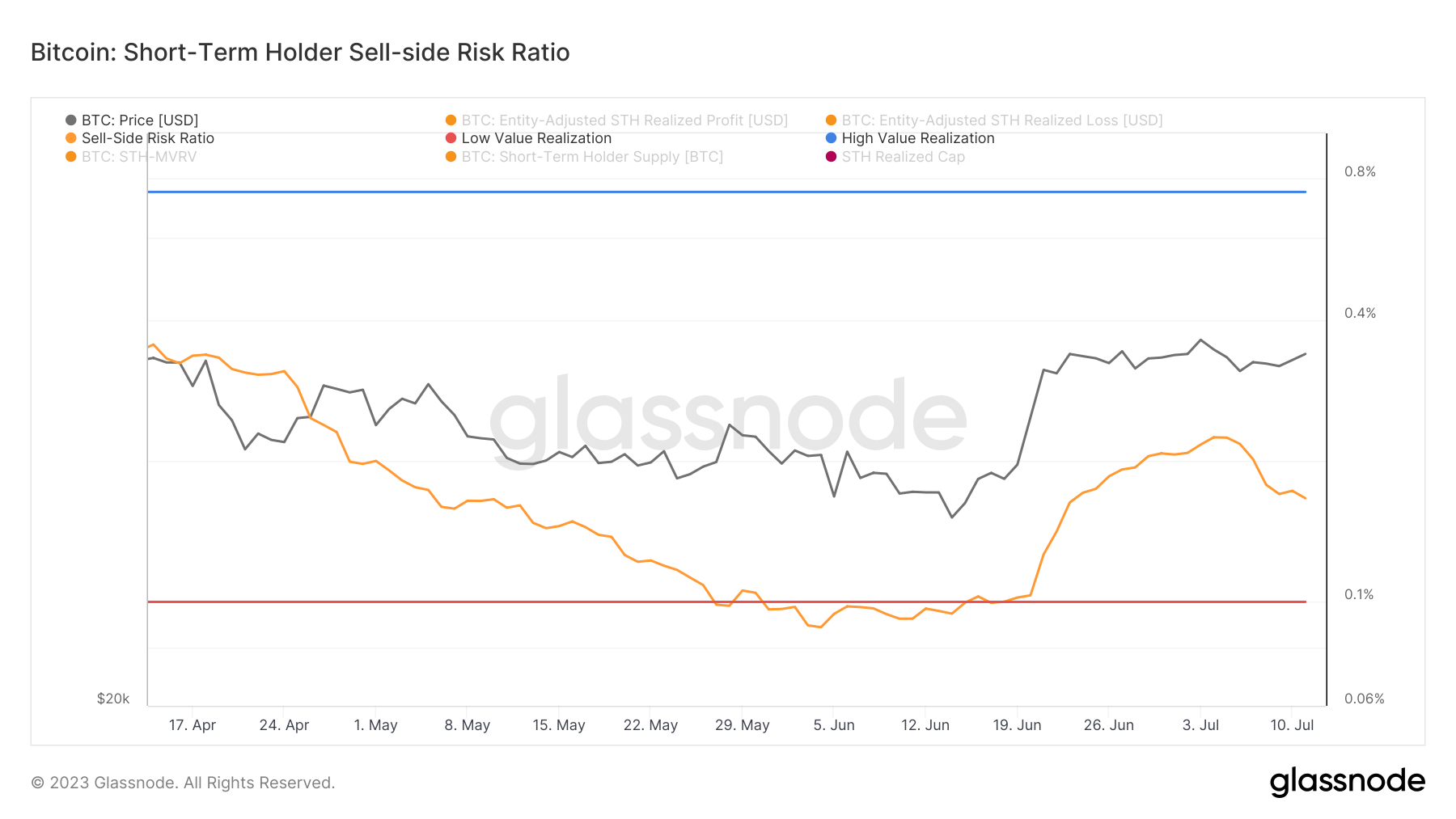

Meanwhile, data from on-chain market analysis platform Glassnode shows that the sell-side risk ratio for short-term holders has declined. The sell-side risk ratio quantifies the aggregate sell-side risk in the market by comparing the total USD value that investors spend each day to the total short-term holder realized capitalization. High values are typically associated with heavy profit-taking, while low values align with market consolidation phases and bear markets.

The ratio began increasing on June 21, peaking on July 5. Since then, the ratio has sharply declined, indicating a decrease in sell-side pressure from short-term holders.

The combination of these two metrics paints an interesting picture. While the profit margin for short-term holders is decreasing, so is the sell-side pressure. This could suggest that short-term holders are choosing to hold onto their Bitcoin, despite the diminishing profits.

This behavior could potentially stabilize the market and create a solid base for future price increases.

The post Why are short-term holders HODLing instead of taking profits? appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  LEO Token

LEO Token  Uniswap

Uniswap  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Filecoin

Filecoin  Mantle

Mantle  Stacks

Stacks  Render

Render  Immutable

Immutable  XT.com

XT.com  OKB

OKB  Pepe

Pepe  Renzo Restaked ETH

Renzo Restaked ETH  Optimism

Optimism  Arbitrum

Arbitrum  Sui

Sui  dogwifhat

dogwifhat  Wrapped eETH

Wrapped eETH  Bittensor

Bittensor  Maker

Maker